Set Default Allocations

Instructions

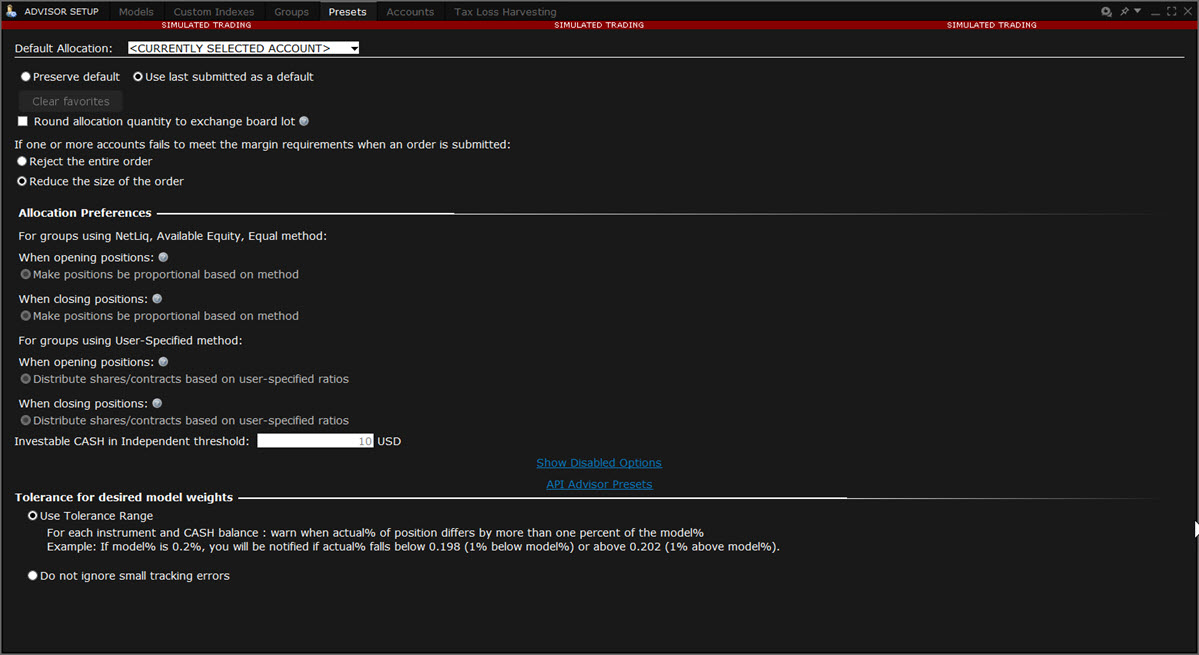

A default allocation is used automatically when you create an order. You can modify the allocation on a per order basis, and change the default allocations and presets at any time.

To Set a Default Allocation

-

From the menu select Advisor Setup.

-

From the Advisor Setup top menu select Presets .

Define Settings Described Below:

Default Allocation:

-

Manual Allocation - Choose an Allocation Profile to use as the default from the drop-down menu

-

Single Account Allocation - choose an individual account to use as the default allocation. NOTE: To allow the last selected individual account to be used for the default allocation going forward, select the Use currently subscribed account radio button at the top of the page.

Preserve default - select to always use the default set up in the Default Allocation window regardless of changes you make on a per-order basis. If this is checked, you will need to use this window to modify the default allocation.

Use last submitted as a default - select if you want the default allocation to change to the allocation you set on a per-order basis. If this is checked, the default allocation automatically changes when you change the allocation on an order.

Round allocation quantity to exchange board lot - A board lot is a number of shares prescribed by a stock exchange as a trading unit. Various non-US exchanges may use variable board lots that are dependent on the price of the stock.

If one or more accounts fails to meet the margin requirements when an order is submitted - For each order, all accounts designated for order allocation are vetted before the order is submitted, to ensure that each account has the capacity to support the designated allocation. In cases where one or some account(s) cannot hold the allocation as specified, the advisor can elect to:

-

Reject the entire order - The entire order is rejected.

-

Reduce the size of the order - The order size is reduced by the quantity that cannot be held, and this quantity is deactivated.

Note: Once the order has been submitted and is working, the quantity of the working order may still change. For example, if an unrelated fill results in one or more of the accounts no longer being able to support the allocation, the order size will be reduced by that quantity. In an opposite scenario, if an account whose allocation was deactivated can now support the allocation, a quantity that was deactivated during the initial order submission may be reactivated and submitted.

Allocation Preference

When Opening Positions: Applies only to orders that use the Available Equity, Equal, and Net Liquidity methods.

-

Make Positions be proportional based on method: The allocation quantities will be proportional across all positions. This setting does not apply to orders for Mutual Funds.

When Closing Positions: Applies only to orders that use the Available Equity or NetLiq automatic allocation methods described above.

-

Make positions be proportional based on method - Based on the selected method (Available Equity or NetLiq) shares are allocated first to the account where the position would be closed prior to opening new positions. New positions will be proportional based on the specified method.

-

Distribute shares based on method selected - Shares are allocated strictly based on the selected allocation method (Available Equity or NetLiq), but will first be allocated to an account where a position will be closed before any new positions are opened.

-

Distribute shares based on method selected - Do not prioritize accounts that are closing position - Shares are allocated strictly based on the selected allocation method (Available Equity or NetLiq), but a new position may be opened before an existing position is closed as no priority is given to accounts that would close positions.

For Groups Using User-Specified Method:

When Opening Positions: This setting controls logic which calculates the desired allocation quantities for the order. This setting does not apply to orders entered in Cash Quantity terms, or orders placed in models.

-

Distribute shares/contracts based on user-specified ratios - Allocate shares/contracts across accounts using custom ratios.

When Closing Positions: This setting controls logic which calculates the desired allocation quantities for the order. This setting does not apply to orders entered in Cash Quantity terms, or orders placed in models.

-

Distribute shares/contracts based on user-specified ratios - Allocate shares/contracts across accounts using custom ratios.

-

Distribute shares/contracts based on user-specified ratios, do not prioritize accounts that are closing position - Allocate shares/contracts using custom ratios without giving priority to accounts that are closing positions.

Investable CASH in Independent threshold: Set a threshold of the amount of cash investable in the independent section of your portfolio.

Tolerance for Desired Model Weightings:

-

Use Tolerance Range: For each instrument and Cash balance: warn traders when the actual % of position differs by more than one percent of the model %. For example, if model% is 0.2%, you will be notified if actual % falls below 0.198 (1% below model %), or above 0.202 (1% above model %).

-

Do not ignore small tracking errors: The system will attempt to correct minor allocation differences

Automatic Allocation - choose a user-defined Account Group and method to use for default allocation.

- AvailableEquity - Requires you to specify an order size. This method distributes shares based on the amount of available equity in each account. The system calculates ratios based on the Available Equity in each account and allocates shares based on these ratios.

Example: You transmit an order for 700 shares of stock XYZ. The account group includes three accounts, A, B and C with available equity in the amounts of $25,000, $50,000 and $100,000 respectively. The system calculates a ratio of 1:2:4 and allocates 100 shares to Client A, 200 shares to Client B, and 400 shares to Client C.

-

Net Liquidation(NetLiq): Requires you to specify an order size. This method distributes shares based on the net liquidation value of each account. The system calculates ratios based on the Net Liquidation value in each account and allocates shares based on these ratios.

-

Example: You transmit an order for 700 shares of stock XYZ. The account group includes three accounts, A, B and C with Net Liquidation values of $25,000, $50,000 and $100,000 respectively. The system calculates a ratio of 1:2:4 and allocates 100 shares to Client A, 200 shares to Client B, and 400 shares to Client C.

-

-

EqualQuantity - Requires you to specify an order size. This method distributes shares equally between all accounts in the group.

-

Example: You transmit an order for 400 shares of stock ABC. If your Account Group includes four accounts, each account receives 100 shares. If your Account Group includes six accounts, each account receives 66 shares, and then 1 share is allocated to each account until all are distributed.

-

-

User-Specified - This selection allows you to create group allocation methods that require user-defined values such as number of units, per-account ratios, per account percentages and per-account monetary amounts.

-

Contracts/Shares: Indicate how many contracts/shares to allocate to each account in the group. After you add accounts to the group, use the empty field to the right of each account to specify an exact number of units to be allocated. This method calculates the order size by adding together the number of shares allocated to each account in the group.

-

Ratio-Based: The Ratios method calculates the allocation of shares based on the ratios you enter. After you add accounts to the group, use the empty field to the right of each account the allocation ratio.

-

Example: An order for 1000 shares using a user-defined method that includes four accounts set to a ratio of 4, 2, 1, 1 would allocate 500, 250, 125 and 125 shares to the listed accounts, respectively.

-

-

Percent-Based: The Percentages method will split the total number of shares in the order between listed accounts based on the percentages you indicate. After you add accounts to the group, use the empty field to the right of each account to specify the per-account allocation percentage.

-

Example: An order for 1000 shares using a user-defined method that includes four accounts at 25% each would allocate 250 shares to each listed account in the group.

-

-

Monetary Amount: The Monetary Amount method calculates the number of units to be allocated based on the monetary value assigned to each account. After you add accounts to the group, use the empty field to the right of each account to specify the monetary value that will be used to calculate unit allocation. The total order quantity is determined by adding together the specified monetary amounts and dividing by the current price.

-

Please Note:

-

While the available Group methods no longer include the Percent Change method as a selection (only Percent-Based), this method can be used to calculate the order quantity when the Group includes positions in the selected instrument. In this circumstance, the Quantity field will show a "% Change" section where you can choose the percent by which you want to increase or decrease positions. Once calculated, the Quantity field will display the percent with either Ind or POS. See details in the Create an Order for Multiple Clients topic.