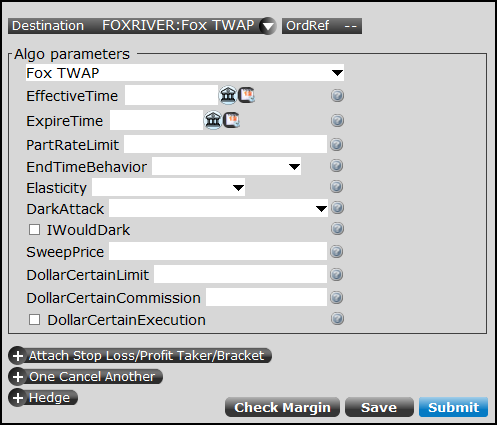

Fox TWAP

Instructions

A time-weighted algorithm that aims to evenly distribute an order over the user-specified duration using Fox River alpha signals. Allows the user flexibility to control how much leeway the model has to be off the expected fill rate. Seeks to outperform TWAP using Fox Alpha and short-term alpha signals.

Field Name |

Description |

Valid Values/ Default Value |

|---|---|---|

|

Effective Time |

Optional. Set the time to begin the order. |

Between market open and market close, and prior to Expire Time (if set). Defaults to immediately. |

|

Expire Time |

Optional. Time/date for the order to expire. |

Between market open and market close, and after Effective Time (if set). Defaults to market close if not set. |

|

Participation Rate Limit |

Optional. The participation of volume rate limit, as a percentage. |

Digit that will be used as a percentage 0 < rate <= 1. Example: 0.05 equals 5% |

|

End Time Behavior |

Optional. Tells how to treat an order that expires. |

Cancel - cancels any remaining balance Hard - Complete the order with give up Soft - If possible, complete the order with no give up |

|

Elasticity |

Optional. Elasticity describes the pacing of the Fox trading signal. This value tells how much leeway the model has to be off the expected fill rate. |

Low, Medium, High. Set the High by default to provide the most flexibility and best performance. |

|

Dark Attack |

Optional. Whether or not to favor dark pools. |

0 - Do not favor dark pools 1 - Least aggressive 10 - Most aggressive Will default to 0. |

|

I Would Dark checkbox |

Optional. Check to allow the order to complete in a dark venue at any time. Very aggressive if set. |

If unchecked, pacing will not be affected by fills from dark venues. |

|

Sweep Price |

Optional. Set a price at which you would be willing to sweep all available equity. |

>0 |

|

Dollar Certain Limit |

Optional. The maximum acceptable dollar amount of the trade, including Dollar Certain Commission. Used to trade by dollar amount. |

>0 |

|

Dollar Certain Commission |

Optional. The commission cost on a cents-per-share basis, e.g. 0.1 = 1 cent |

>0 |

|

Dollar Certain Execution checkbox |

Optional. Check to determine the order quantity by dollar value. Must be checked for other "Dollar Certain" fields to be valid. |

If checked, Dollar Certain Limit at least must be defined. |