Update Tax Forms

Instructions

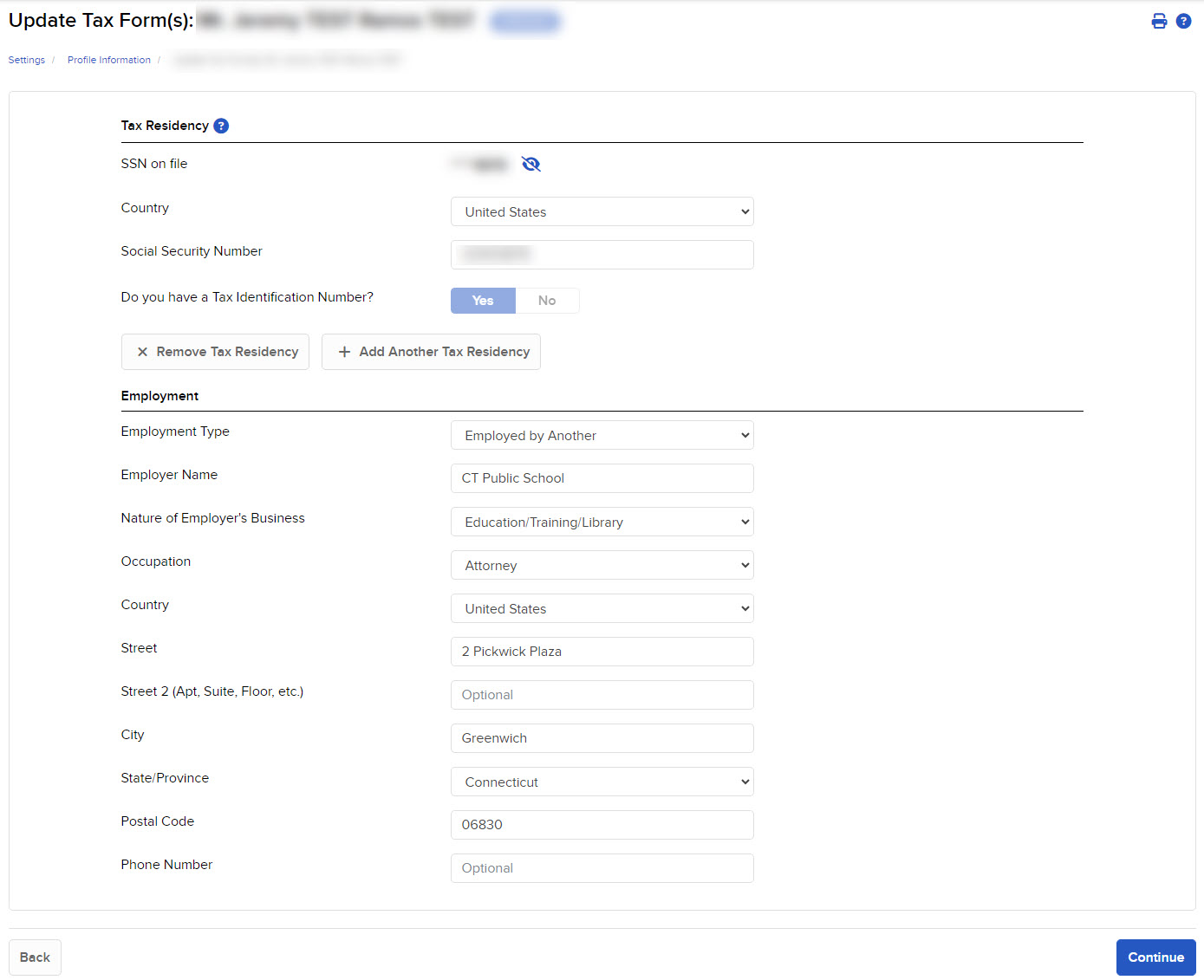

The Tax Form Collection page lets account holders review and update important tax-related information. Account holders who are legal residents and citizens of the U.S. (the U.S. is your country of organization formation and organization registration) can fill out or update IRS Form W-9 (Request for Taxpayer Identification Number and Certification). Account holders who are neither a legal resident nor citizen of the U.S. can fill out or update IRS Form W-8.

To update tax forms:

-

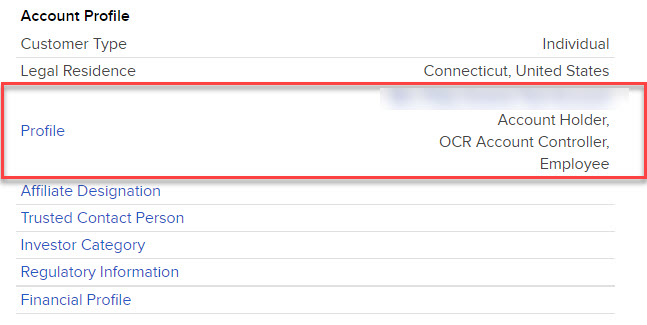

Click the User menu (head and shoulders icon in the top right corner) > Settings > Account Profile

-

Click Profile

-

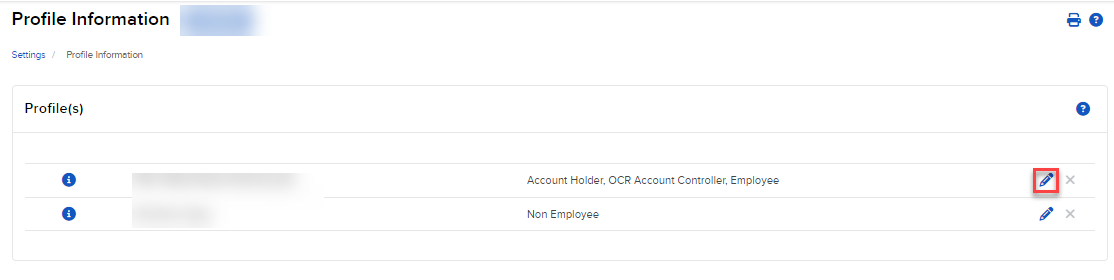

Click the edit (pencil) icon to the right of the entity.

-

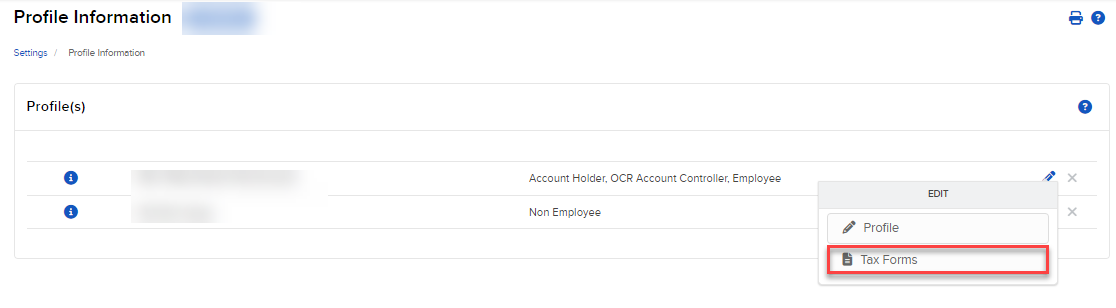

Click Tax Forms.

-

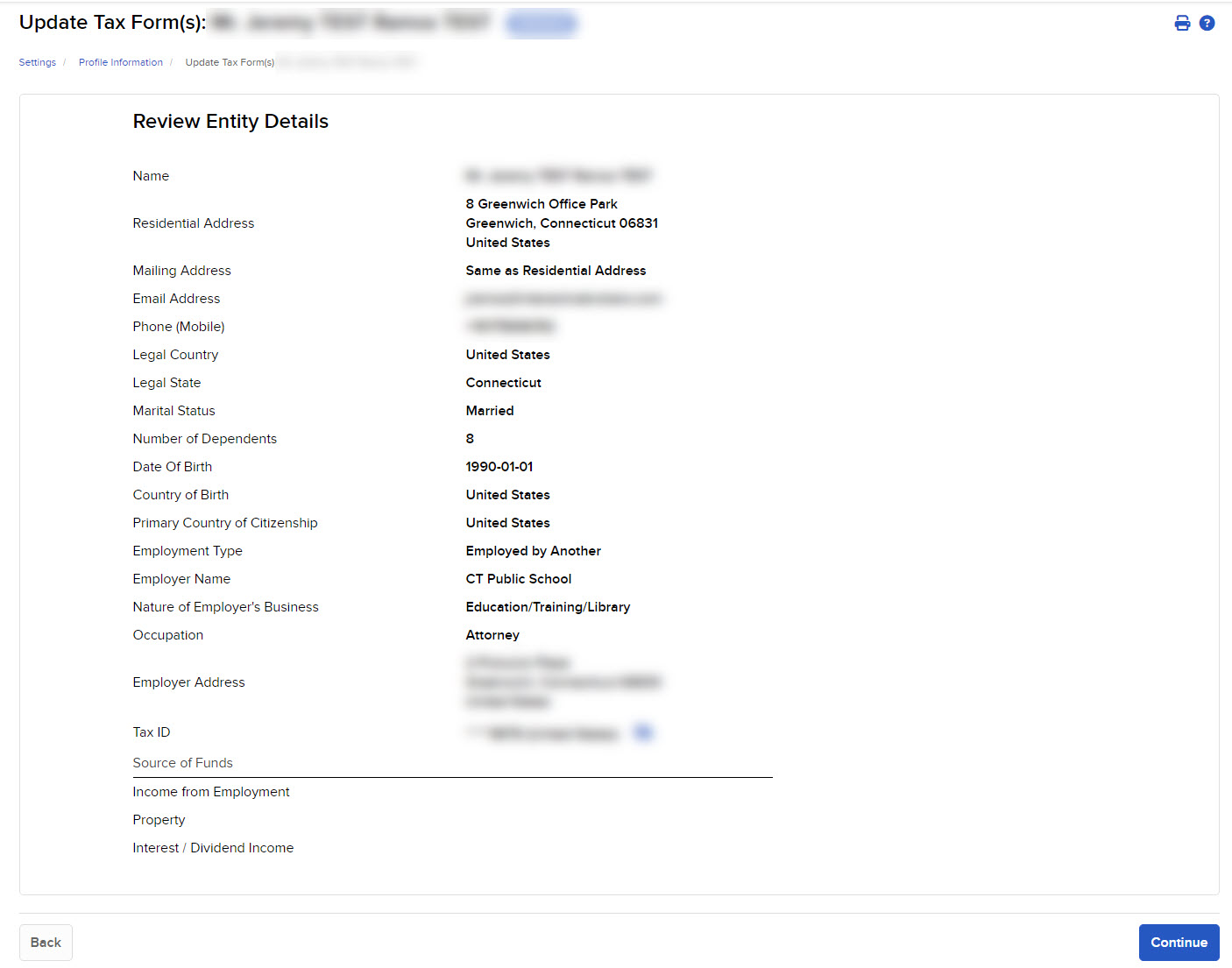

Profile information appears; modify it as required, then click Continue.

-

Update the tax forms.

-

Verify your information, then click Continue.

If you need to make changes, click Back.

-

If you do not participate in the Secure Login System for two-factor authentication, you will receive an email with a confirmation number. Enter the confirmation number sent to you via email, then click Continue. If you have not received a confirmation number, click Request Confirmation Number to have a new confirmation number sent.

-

Click Ok.

-

Make changes as needed and click Continue to review entity details.