Scan a Check

Instructions

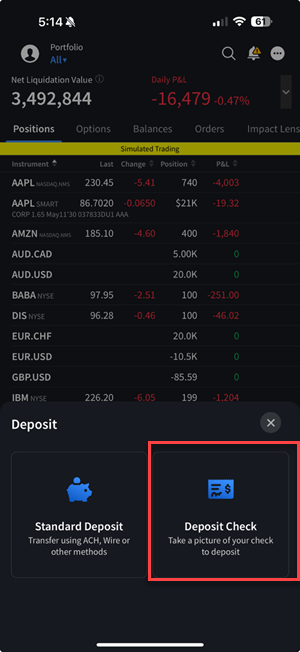

You can deposit checks directly into your account using Mobile Check Deposit. Select how you would like to make your deposit on the Deposit Funds page.

To scan a check:

-

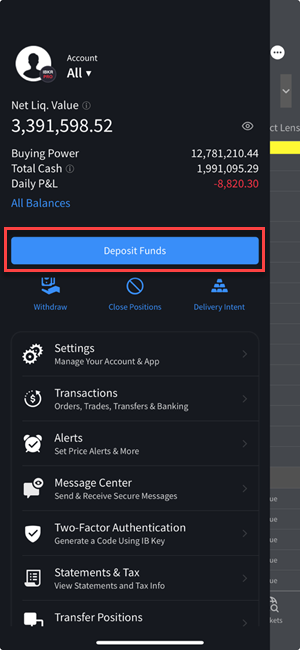

Tap the Account menu icon (head and shoulders) in the top left corner of the app.

-

Tap the Deposit Funds button.

-

Select Deposit Check.

-

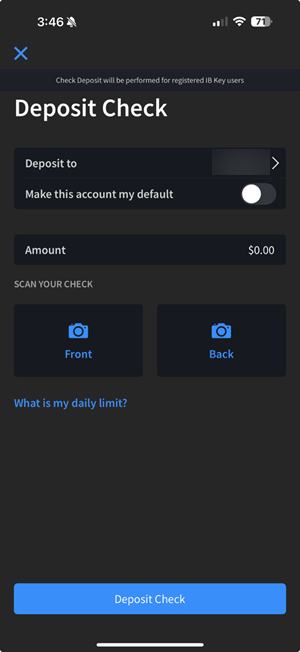

If you hold multiple accounts, select the appropriate one in the Deposit To field.

-

Enter the amount of the check in the Amount field.

-

Tap Front and position the field over the front of the check until the check scans.

-

Tap Back and position the field over the back of the endorsed check until the check scans.

-

Tap Deposit Check when complete.