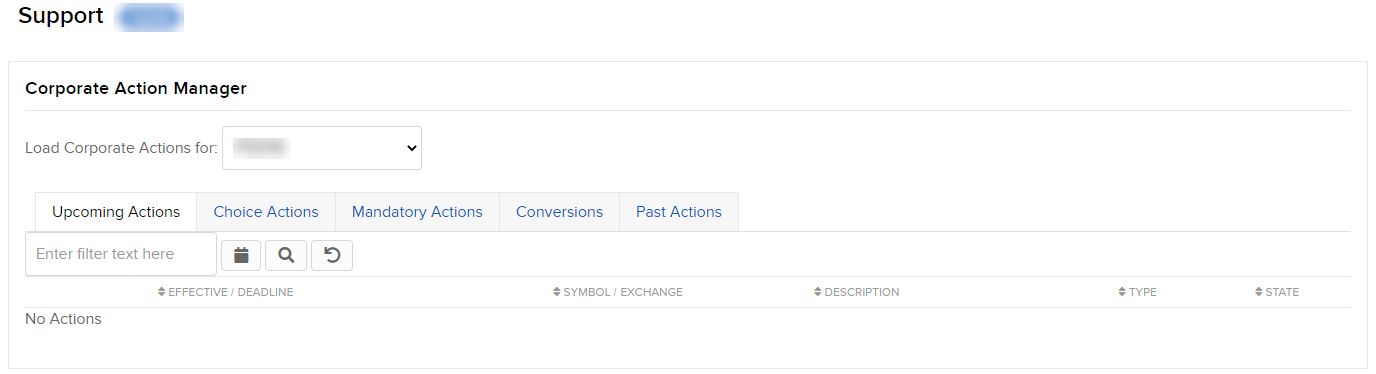

Corporate Action Manager

Instructions

This tool allows you to review information on upcoming mandatory and voluntary corporation actions relating to positions held in the account, and submit elections to IB for voluntary offers.

To access the Corporate Action Manager from Client Portal:

-

Click Get Help > Corporate Actions Manager.

In the event a shareholder wishes to take part in a dutch auction tender offer at a specific bid price or prices, the following steps may be taken to submit the election through IB's Corporate Action Tool.

-

Navigate to the appropriate line item which indicates you wish to submit shares at Bid Price.

-

Click on the Change link on the far right.

You will be presented with a new screen which provides information on the bid price rules and the position eligible for election.

-

Enter the quantity you wish to submit and the associated bid price you wish to submit for. Note that the entry must in the form of a share quantity (we do not accept a percentage of shares held.)

-

Select either:

-

Add Row, which will provide another election row should you wish to submit shares at a second bid price.

-

Done, located on the bottom right of the screen, if you have completed your election.

-

-

Once you have selected Done from the bid price election screen, you will be returned to the main election screen where you will see the quantity of shares you intend to submit. To review your election or edit your bid price, select Change again.

-

Once all of your elections have been made, review and check that you agree to the Terms and Conditions, then select Save to submit your election.

Note: If the total quantity of shares submitted to a voluntary corporate action exceeds the total share quantity held in the account at the time of the offer deadline, IB reserves the right to pro-rate each election previously submitted without sending notification to the client. Please monitor the account to ensure that an over-election has not been made.

Example of pro-rated instructions

Scenario

At the time of the initial election, an account is long 2,000 shares of stock ABC. Elections are submitted as follows:

Option 1 (default) elect 1,500 shares

Option 2 elect 500 shares

If 500 shares are sold prior to the election deadline, the elections will be adjusted as follows:

Option 1 (default) elect 1,125 shares

Option 2 elect 375 shares

If 500 shares are purchased prior to the election deadline, the elections will be adjusted as follows:

Option 1 (default) elect 2,000 shares

Option 2 elect 500 shares

In the event an account is short the target security the day prior to the effective date of a subscription rights offering, the account will be allocated a short position in the subscription right security at a rate determined by the terms of the offer.

In the Event the Subscription Rights are Not Listed for Trading

Customers who are short the subscription rights may be held liable in the event the long holder submits a request to subscribe to the rights offer. Customers should be aware of the potential liability to the account based on all or a portion of the short rights position being subscribed to, plus any over-subscription allocation. Customers should monitor their accounts to ensure they will be able to properly deliver any required shares if they are held liable.

IB will not know the liability for a given account until shortly after the close of the subscription rights offer.

If the Subscription Rights are Listed for Trading:

Customers who are short the subscription rights may attempt to close their position by submitting an order through IB's Trader Workstation (TWS). In the event a client is unable to close the position through the placement of an order, the client may contact the IB Trade Desk by telephone to ask that a closing transaction be placed on their behalf.

IB will set a close out deadline for the subscription rights offer typically, though not definitively, as follows:

(External processing deadline) - (Settlement period of the market + 1) business days.

For example:

For a subscription rights offering with an external processing deadline of Thursday in the United States the close out date would typically be:

Thursday - (3 business days + 1) = the prior Friday.

IB will attempt, on a best-efforts basis, to close out any remaining short positions on the close out date (standard commission rates apply). IB does not guarantee the date, time, price, or ability to execute such a closing trade. If IB is unable to close out the remaining short positions, clients will be responsible for any associated liability, should the long holder ask to subscribe to the rights offer.

Once IB executes a closing trade for the remaining short positions, a notification will be sent to the account holder indicating that a close out has been processed. IB will post the closing transaction to the account as soon as practical. IB may not be held liable in the event the notification is not delivered in a timely fashion. If a client elects to close out a short rights position after the IB close out date without first confirming with IB regarding the status of the close out, such action may result in the account being long the rights position.

How to allocate shares to a voluntary corporate action?

-

Enter the number of shares you wish to allocate to a given option in the column “New Election”.

-

Once the “New Election” accurately represents the desired election instruction, select Save.

-

Read the voluntary corporate action agreement and if you agree to the terms therein, select I Agree.

-

IB will send confirmation to the IB Message Center within 30 seconds of the acceptance of your choice. In the event a confirmation is not received, a client must contact IB, as non-confirmed elections will not be processed.

The above steps may also be followed when submitting an election to a Stock Purchase Plan (SPP); note, however, that the election must be submitted as a value of stock you wish to purchase in the offer.

What will happen if I do not elect?

If no election is submitted and acknowledged by IB, the default allocation will be processed for the non-electing shares.

Am I able to see my election history?

Yes. Once an election has been submitted and acknowledged by IB, you may view the information in either the Message Center as a ticket or by selecting the Election History link on the election screen (next to the position information). This will provide an overview of the elections submitted to IB.

Will my election be processed if I do not receive an acknowledgement from IB?

No. If IB does not supply an electronic acknowledgement of a voluntary corporate action election, you must contact IB to confirm the election. IB will process only those elections which have been acknowledged electronically.

Can I submit an election after the deadline?

Elections cannot be made through Account Management once the deadline of the offer has passed. After the deadline, you may submit instructions through an Inquiry Ticket; however please note that all instructions submitted in this manner will be handled on a best-efforts-only basis. IB cannot guarantee that instructions submitted after the deadline will be successfully processed.

Why is the screen reflecting a 0 as the eligible position when I own 1,000 shares?

the account is ineligible to participate in an offer, the election screen will reflect a 0 eligible position. Eligibility may be restricted based on the terms of the offer. If an account is deemed ineligible but the account holder believes it should be eligible, please contact IB by creating a ticket in the Message Center.

Am I able to modify my election?

Provided the election deadline has not been reached, you may update your election through the same Account Management Corporate Action Manager tool. Once you launch the offer, you may edit as follows

-

Enter a zero as the New Election to remove an existing submission, or

-

Select Remove All Allocations if you are a master user acting on behalf of your client accounts

Once the election has been removed, re-enter your new quantity.