Greeks

Instructions

The Greeks widget lets you measure option price sensitivities with Greeks: Delta, Gamma, Theta, and Vega.

To navigate to the Greeks widget, follow the steps below.

-

Select Performance & Reports > PortfolioAnalyst > Navigate to the Greeks widget.

-

Alternatively, click Menu in the top left corner > PortfolioAnalyst > Navigate to the Greeks widget.

-

-

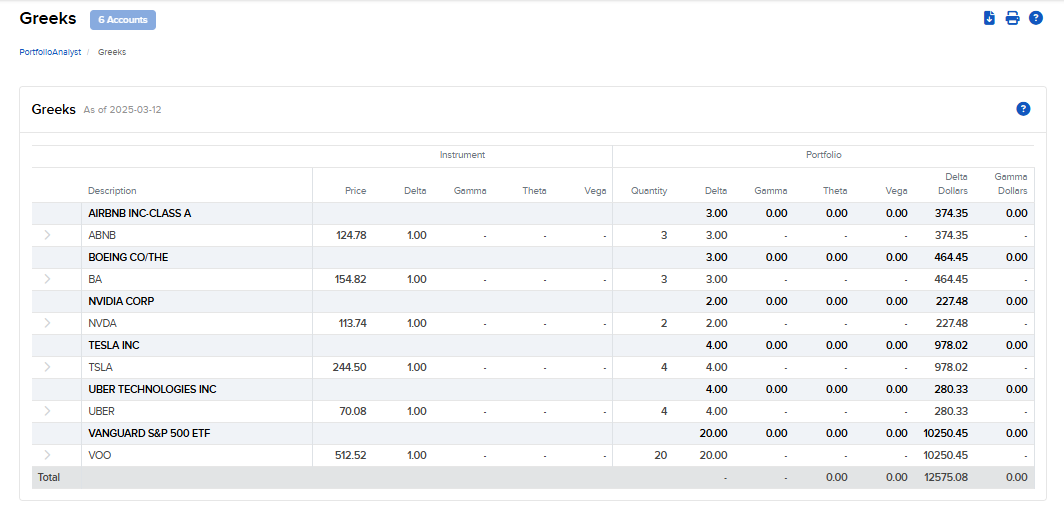

Select the blue arrow icon in the top right corner to view additional details.

-

A new page will populate with additional information regarding your greeks.

Instrument Greeks:

-

Delta - The ratio of the change in the price of the option to the corresponding change in the price of the underlying.

-

Gamma - The rate of change for delta with respect to the underlying asset's price.

-

Theta - A measure of the rate of decline of the value of an option due to the passage of time.

-

Vega - The amount that the price of an option changes compared to a 1 percentage point change in volatility.

Position Greeks:

-

P. Delta - This position delta captures both the direction and the magnitude of the portfolio's sensitivity to an underlying by representing the degree and direction of change in the option price based on a change in the price of the underlying. This value is calculated as (delta * position).

-

P. Gamma - Helps you assess directional risk by defining the speed at which the option's directional changes will occur, i.e. the rate of change of delta. This value is calculated as (gamma * position).

-

P. Theta - Theta represents the position's sensitivity to the passage of time by indicating the rate at which the market value of your portfolio will change with time. This metric calculation is based on the assumption that all other variables remain unchanged, including the underlying price, implied volatility and interest rate. This value is calculated as (theta * position).

-

P. Vega - Represents the position's sensitivity to changes in implied volatility of the underlying and shows the change in the price of an option relative to a change in the implied volatility of the underlying. Generally long option positions benefit from rising (and suffer from declining) implied volatilities, while short option positions experience the opposite - they benefit from declining (and suffer from rising) implied volatilities. This value is calculated as (vega * position).

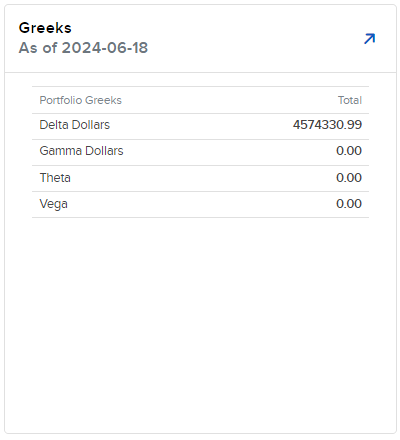

Portfolio Greeks:

-

Delta Dollars

-

Gamma Dollars

-

Theta

-

Vega

-

You may additionally create a custom report with Greeks included by taking the steps outlined in Create a New Custom Report.