Trust

A trust account is a legal arrangement in which assets are held by a third party (the trustee) for the benefit of another party (the beneficiary) according to the terms established by the grantor (also known as the settlor). Trust accounts can be used for estate planning, asset protection, or charitable purposes and are governed by a formal trust agreement. They can hold a variety of assets, including cash, real estate, securities, and business interests.

Trusts are often categorized as revocable or irrevocable, depending on whether the grantor retains the ability to alter or terminate the trust after it is established. For more information, review the Guide to Choosing the Right Account page and the What You Need for the Application page.

To open a Trust account, follow the steps below.

-

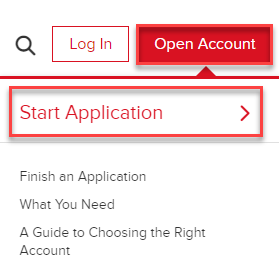

Navigate to ibkr.com and select the Open Account button in the top right corner, followed by Start Application.

-

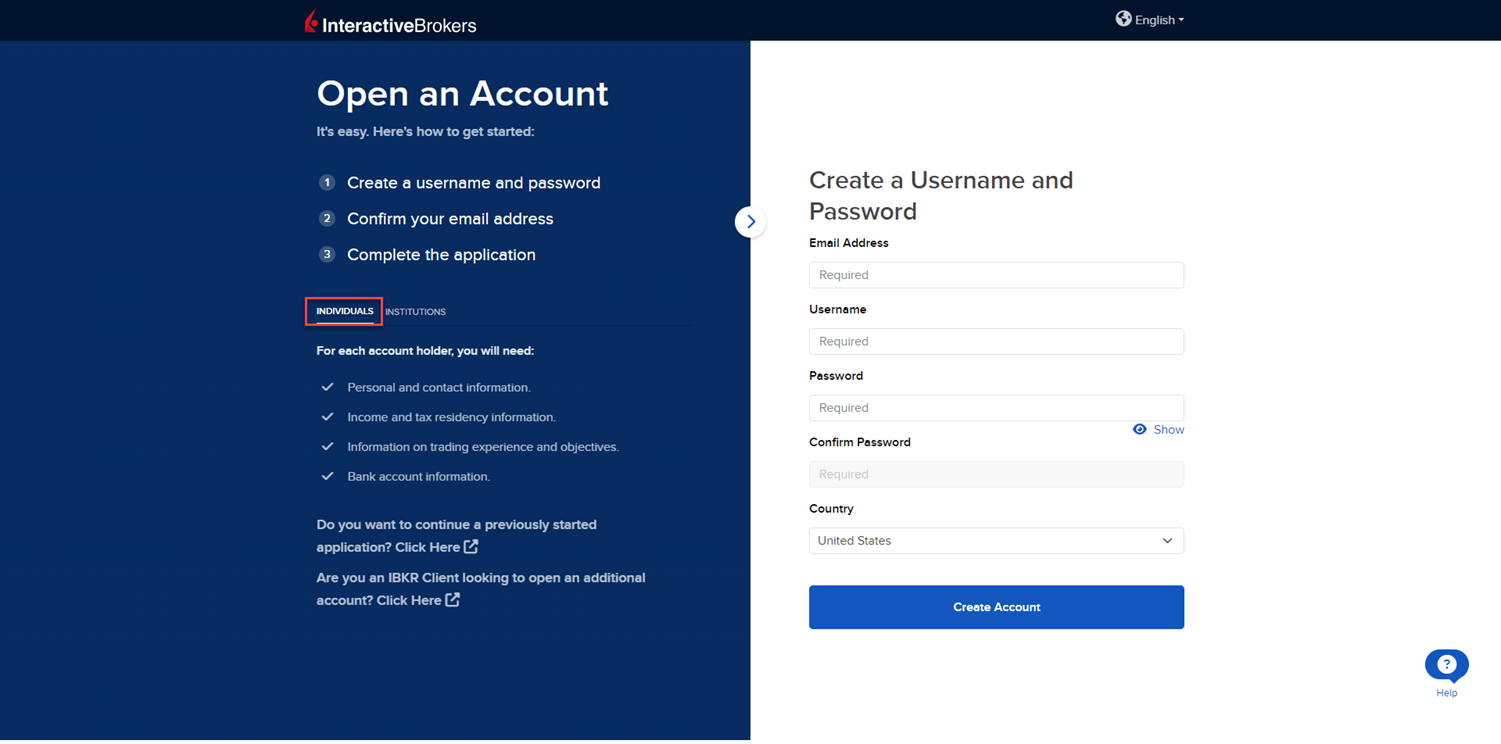

Select the Individual tab on the left side and input an email address, username, password, and country for this account.

-

Select Create Account.

-

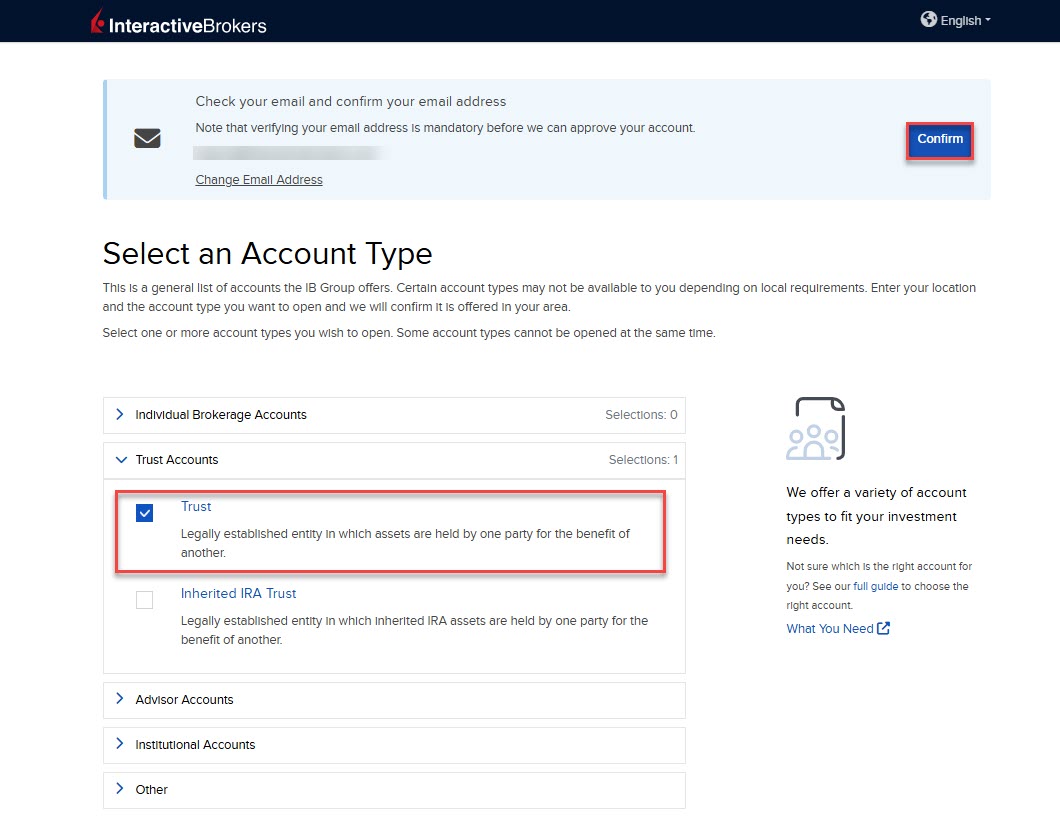

Confirm your email address by selecting the blue Confirm button in the top right corner. Select the Trust Accounts drop-down menu followed by Trust.

-

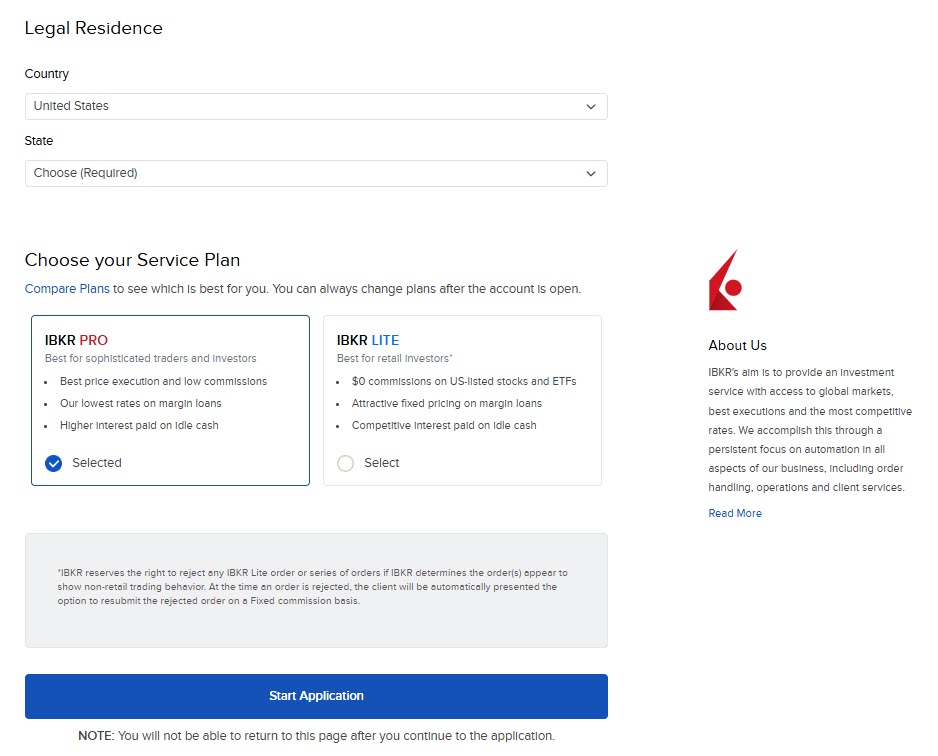

Enter the State of Legal Residence and click Start Application.

-

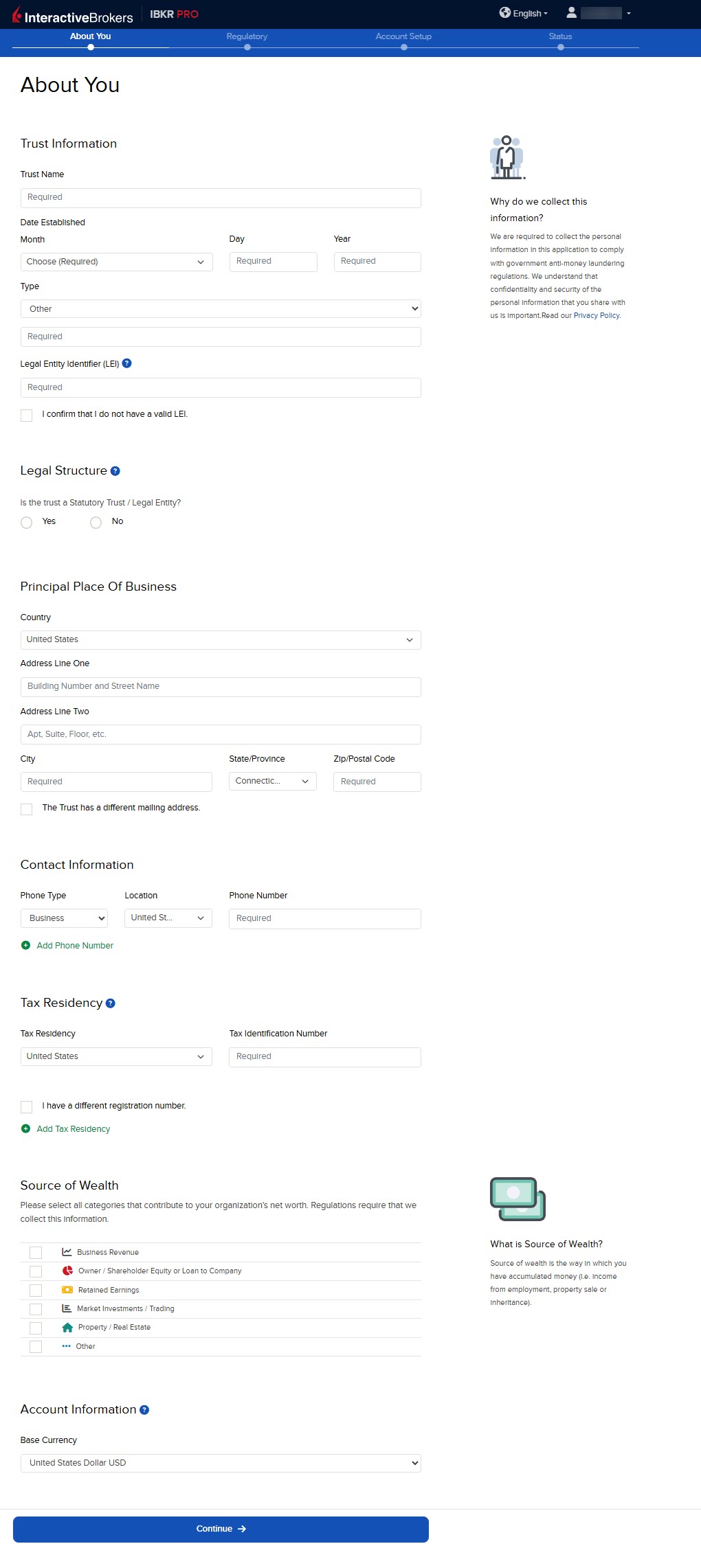

Complete the About You section and press Continue. Choose the Trust Account Type (listed below). Any additional questions specific to that account type will appear.

-

Revocable Living Trust

-

Regulated Retirement Trust (Qualified Retirement Plan)

-

Regulated Retirement Trust (Non-Qualified Retirement Plan)

-

Irrevocable Trust

-

Testamentary Trust

-

Other

Note: To the extent required by law, we will take appropriate technical and organizational measures to keep your personal information confidential and secure, in accordance with our internal procedures covering storage, disclosure, and access. To review our privacy policy, click here.

-

-

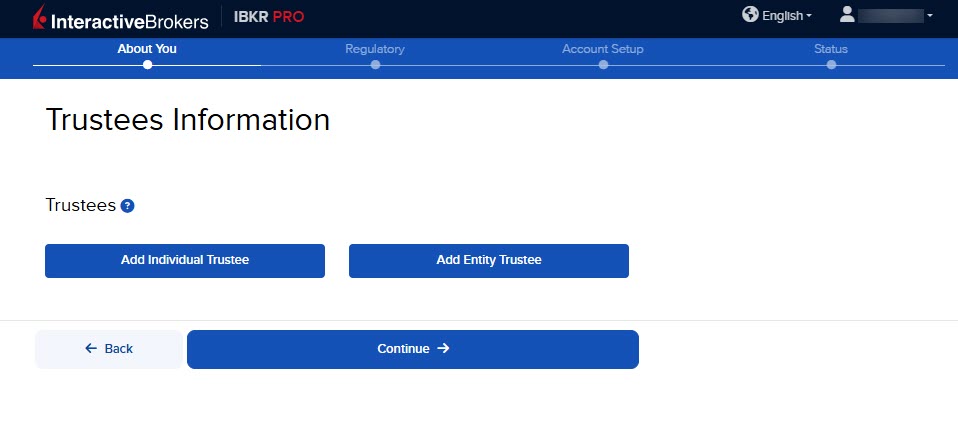

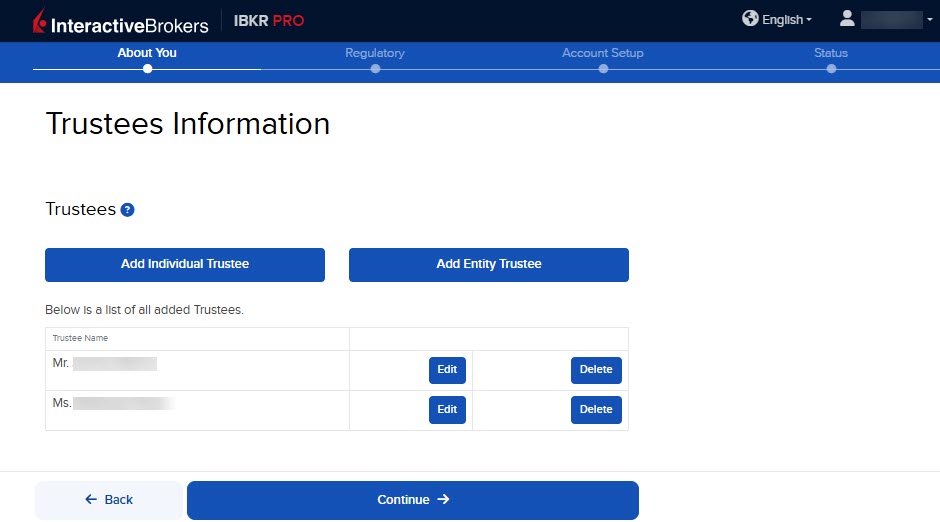

The Trustees Information page will populate. Click Add Individual Trustee or Add Entity Trustee.

-

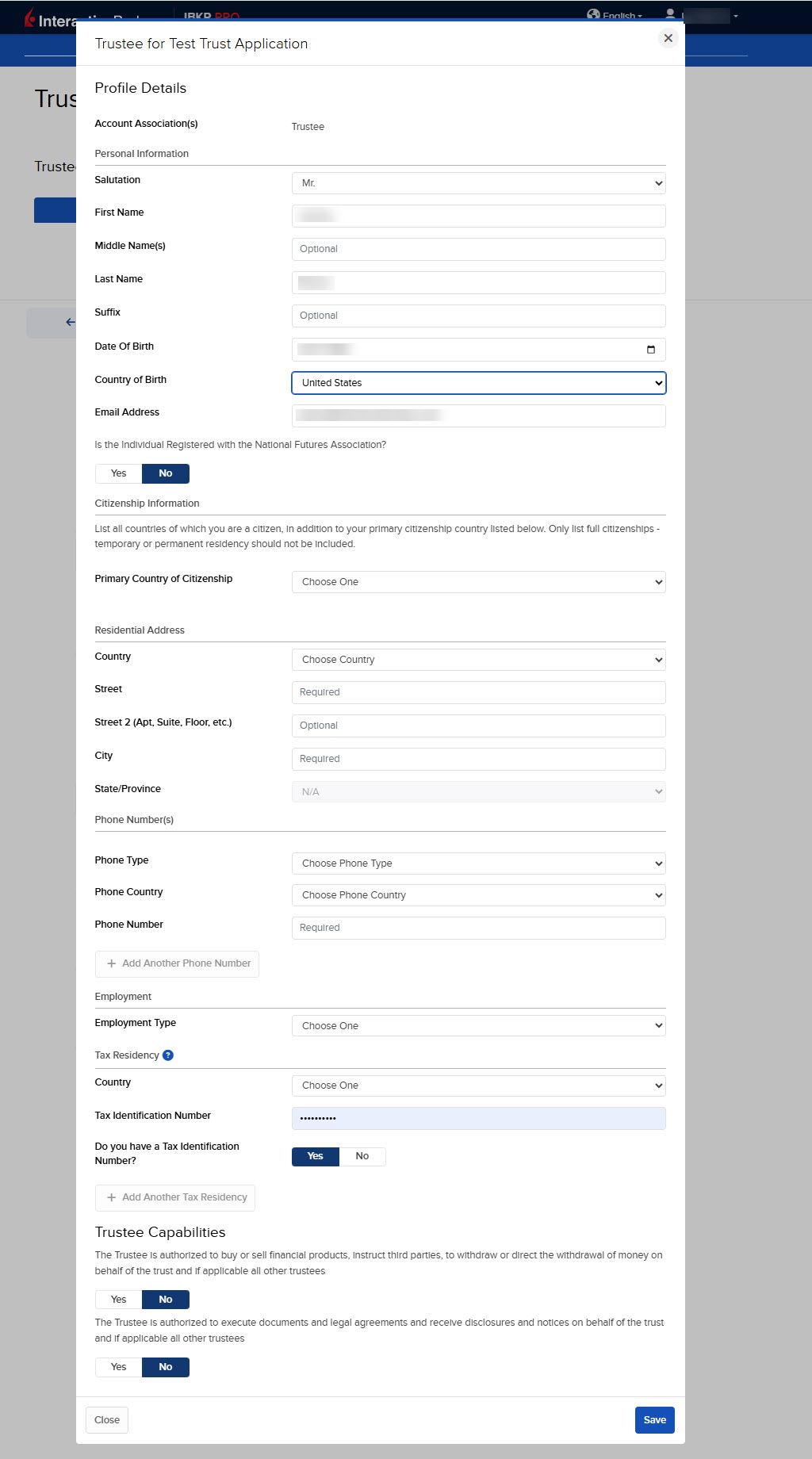

Fill out the required information and press Save.

-

A minimum of one Signatory Trustee and one Trader Trustee is required. After entering the information, press Continue.

-

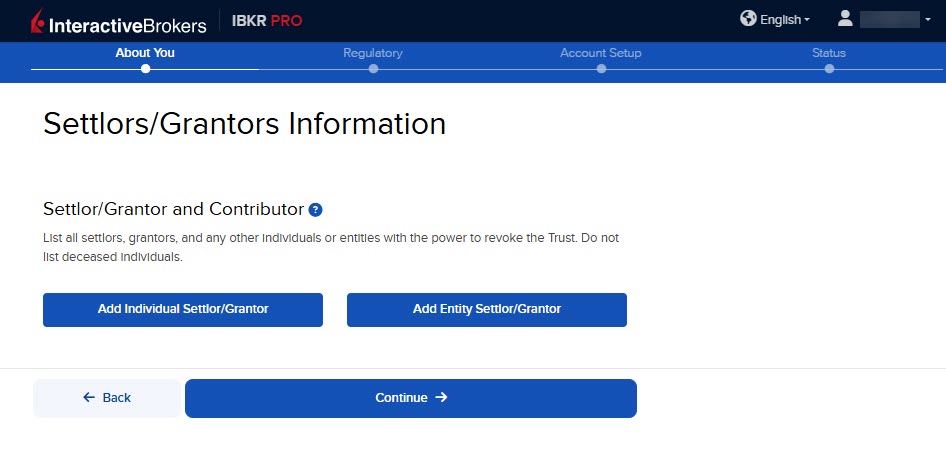

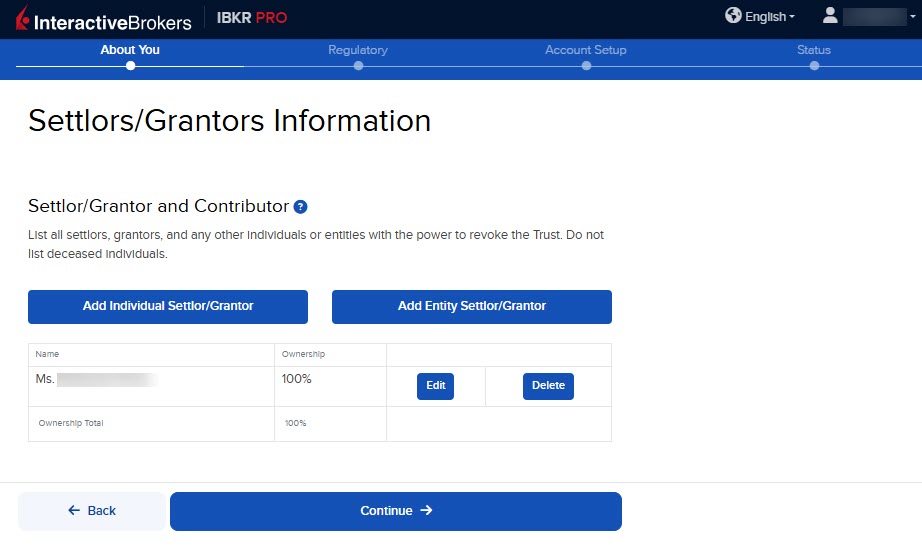

Enter the Settlors/Grantors Information by clicking Add Individual Settlor/Grantor or Add Entity Settlor/Grantor.

-

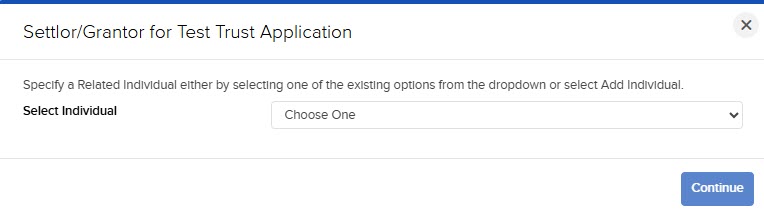

Add or Select an individual from the drop-down list and press Continue.

-

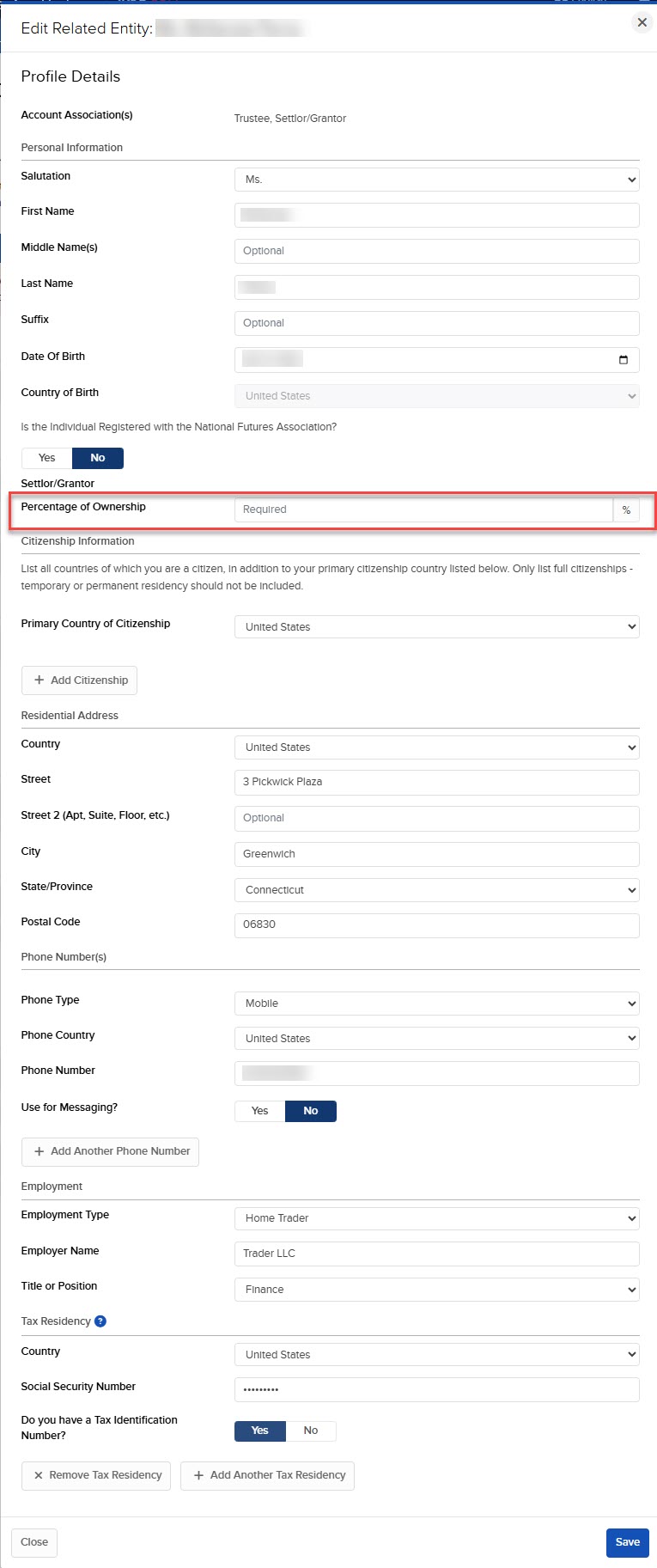

Add the percentage of ownership for the individual. Note that the total must be 100%.

-

When you have added all Settlor/Grantor information, press Continue.

-

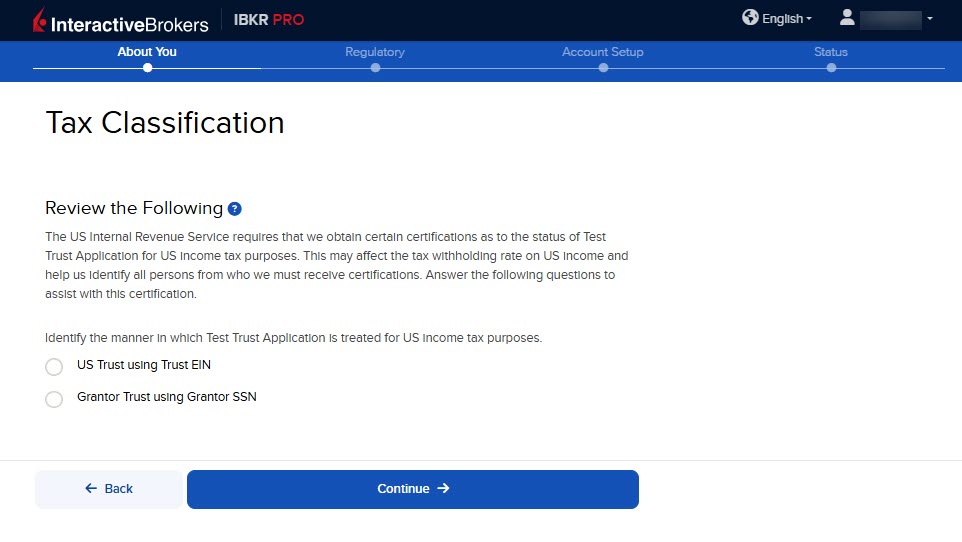

The next page is the Tax Classification section. Enter the information and press Continue.

-

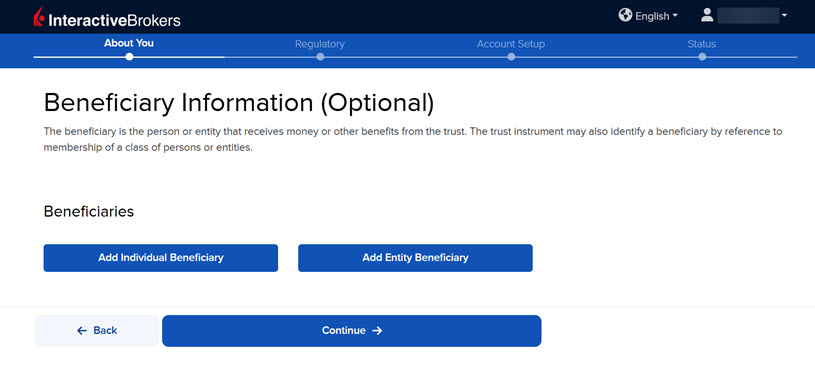

The Beneficiary Information screen is an optional section. When you are ready, press Continue.

-

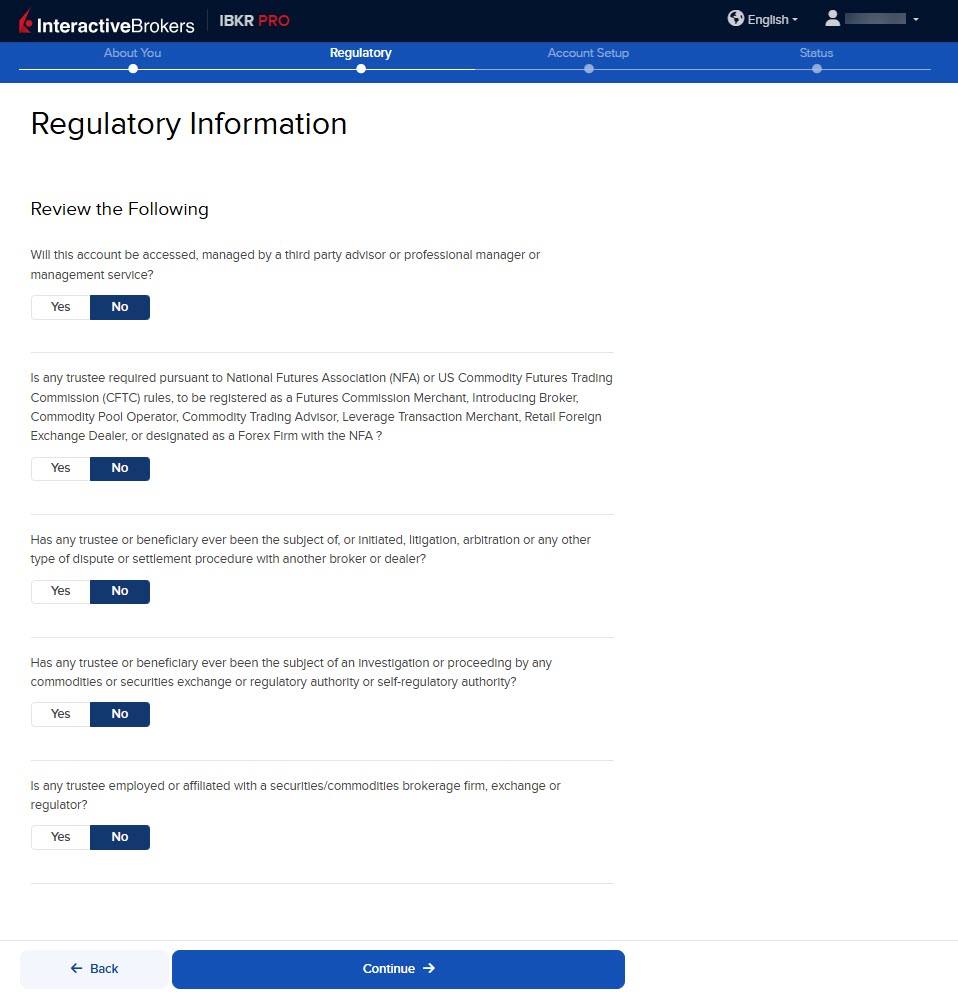

Enter the Regulatory Information and press Continue.

-

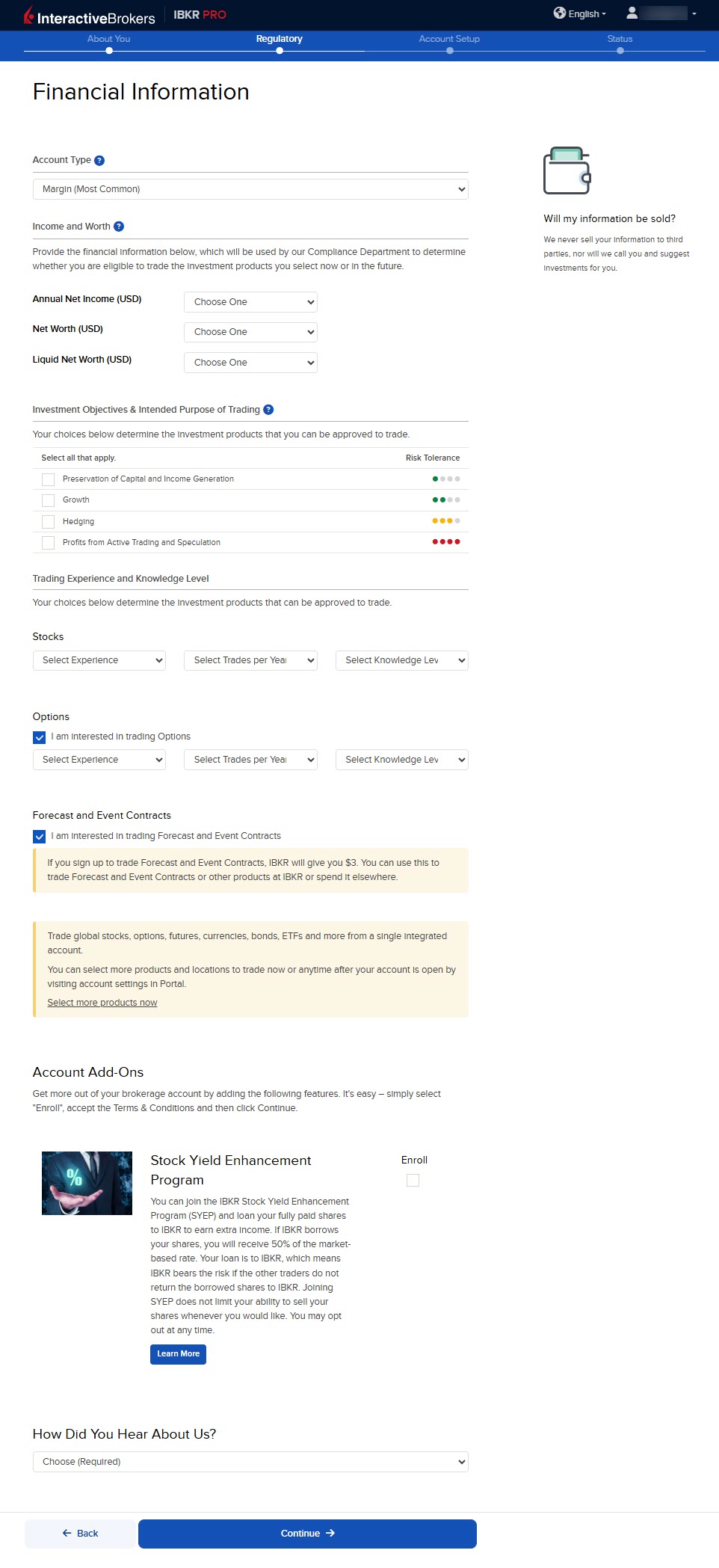

The next page is the Configure Your Trading Account page. When you are ready, press Continue.

-

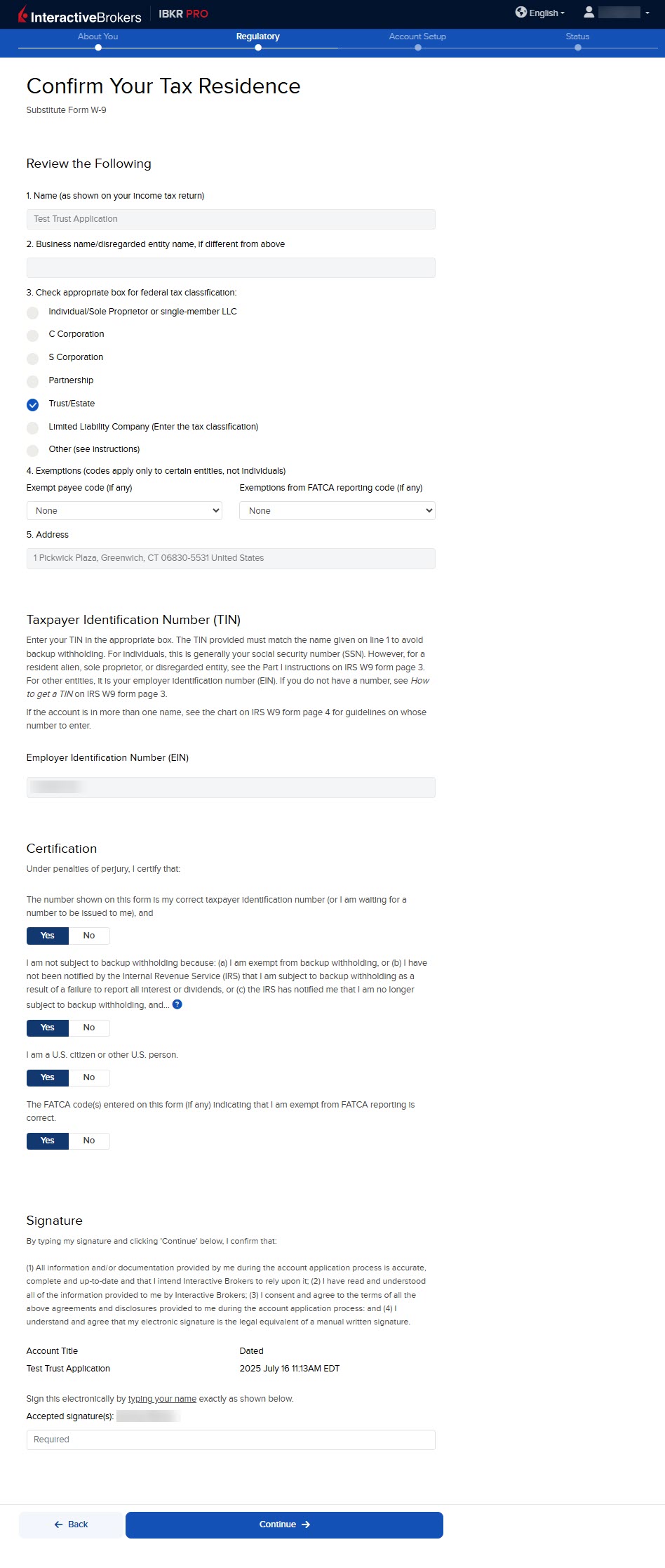

The following page is the Confirm Your Tax Residence section. Fill this out accordingly and press Continue.

-

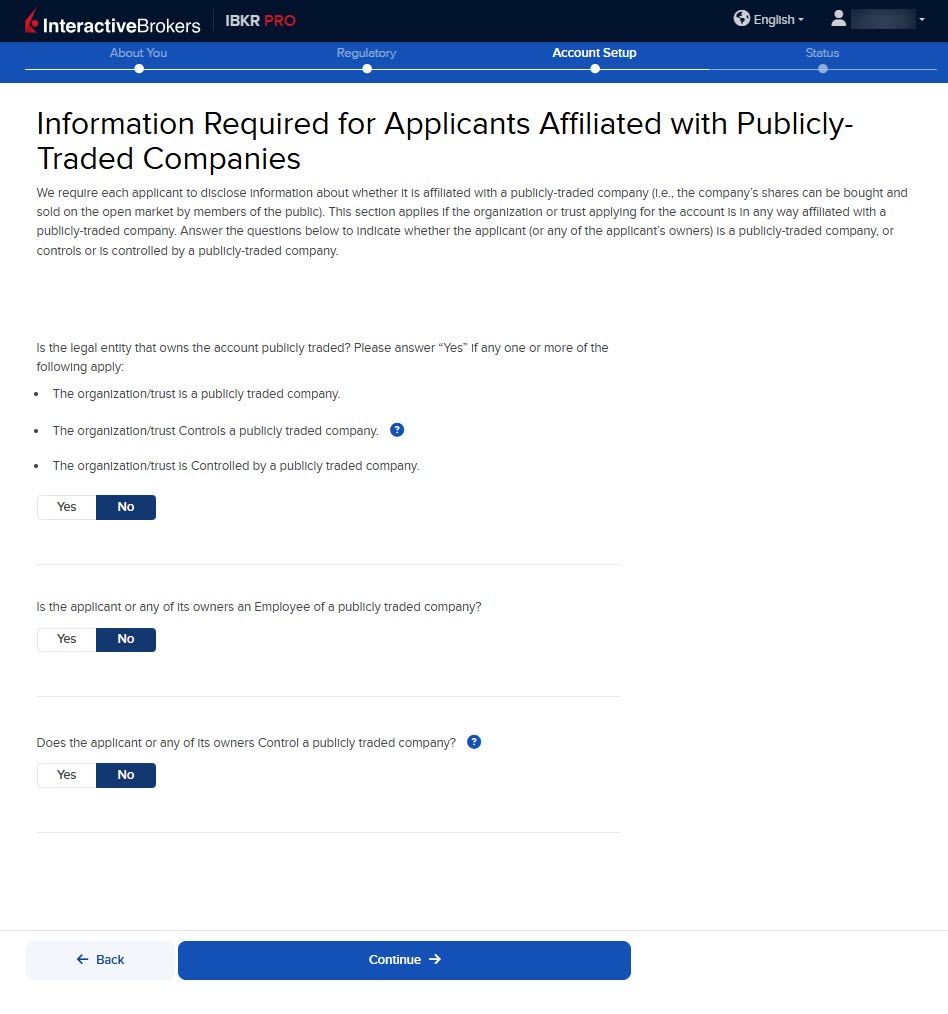

Complete the Information Required for Applicants Affiliated with Publicly Traded Companies page and press Continue.

-

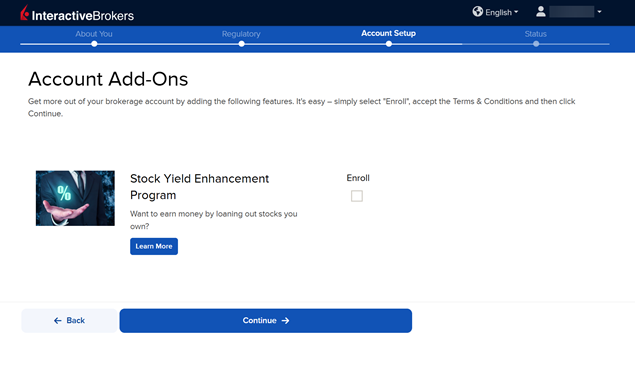

The Account Add-On section will populate on your screen. The Stock Yield Enhancement Program provides extra income on the fully-paid shares of stock held in your account by allowing IBKR to borrow your shares in exchange for collateral (either U.S. Treasuries or cash). IBKR then lends the shares to traders who want to sell them short and are willing to pay a fee to borrow them. To enroll, click the Enroll check-box and press Continue. If you do not want to enroll at this time, leave the check-box blank and click Continue.

-

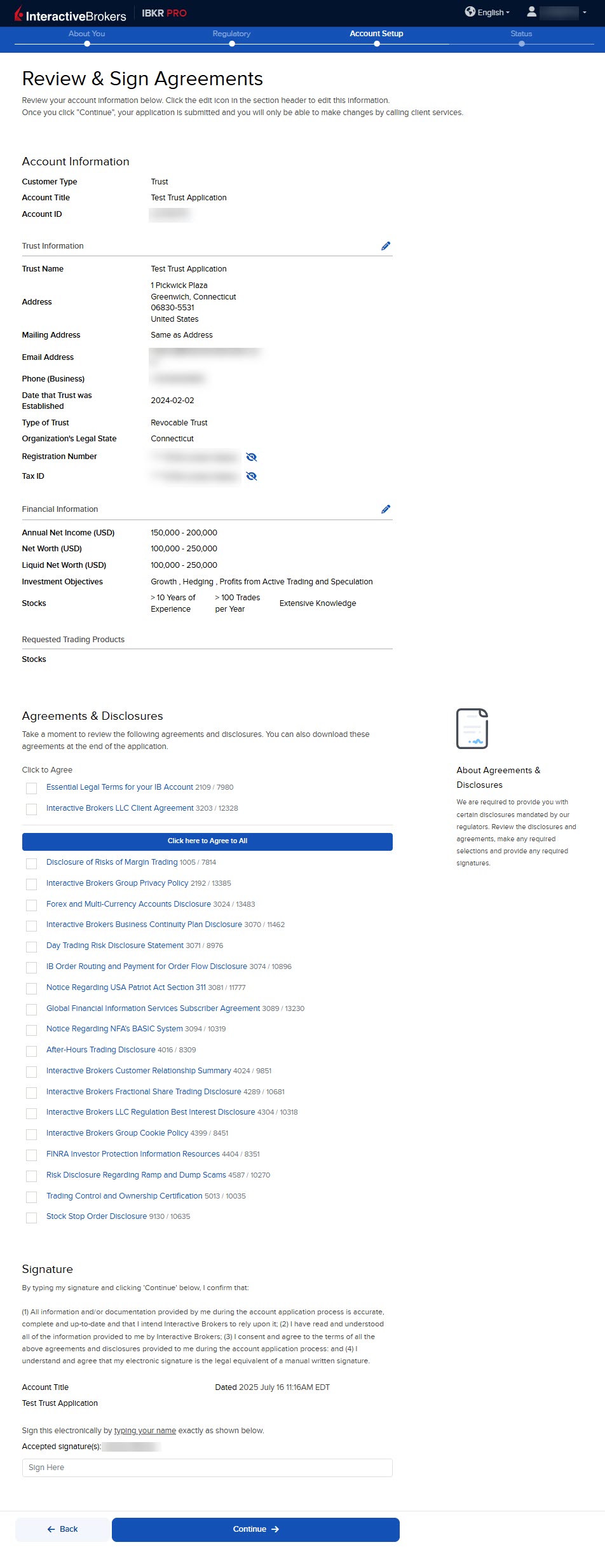

Complete the Review & Sign Agreements section. Click the check-boxes to sign agreements and provide your signature at the bottom of the page, then press Continue.

-

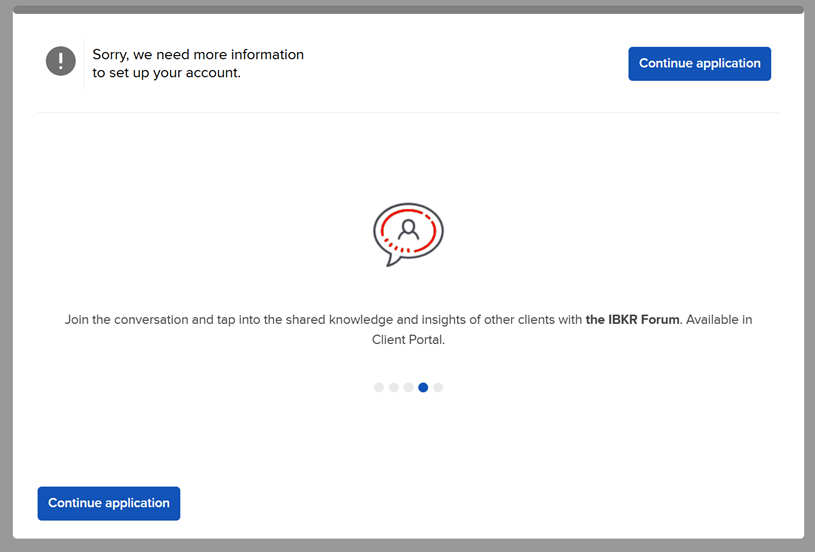

If the following pop-up appears on your screen, click Continue application.

-

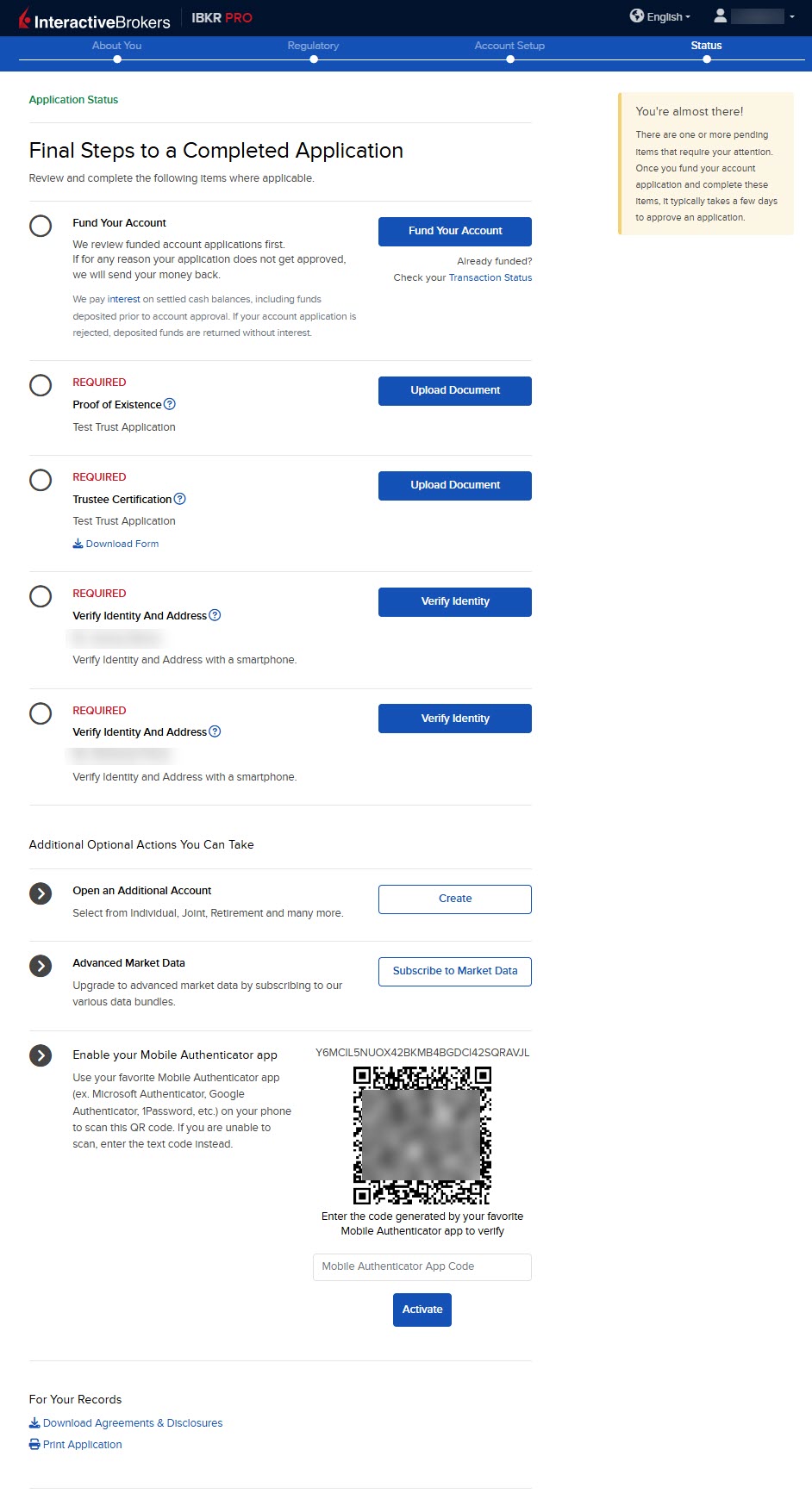

The Status section is the final page. Any additional information or documents needed to complete your application will be marked "REQUIRED" or "Not Yet Received" in red letters. Select the blue buttons to Fund Your Account, Answer Questions, Verify Identity, and Upload Documents.

-

Once all of these steps have been completed, a member from our back office team will review the application and any submitted documents. Once the account has been approved and opened, you will receive an email from Interactive Brokers advising that your account has been activated and you may log in at any time to start trading.

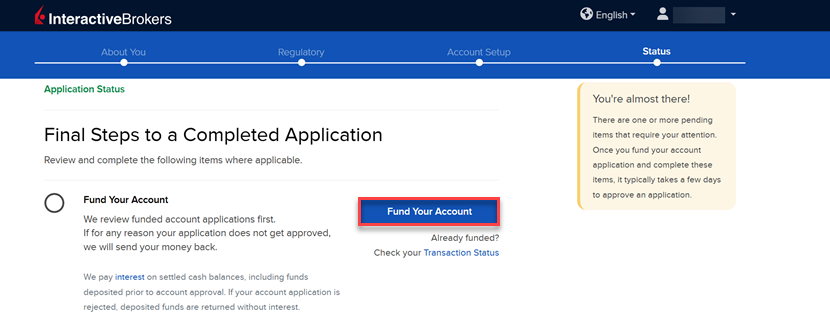

How to Fund Your Account During the Application

Funding your account during the application process is optional. However, doing so will push your application to a priority review. Funding your account may done by transferring cash from a bank account, or by transfer securities from your previous custodian. To do so, please take the steps outlined below.

Please note, securities transfer requests are sent to your current custodian only after your IB account is approved and opened. Once approved, contact your current custodian to confirm they received the transfer request.

-

On the final page, click the Fund Your Account button.

-

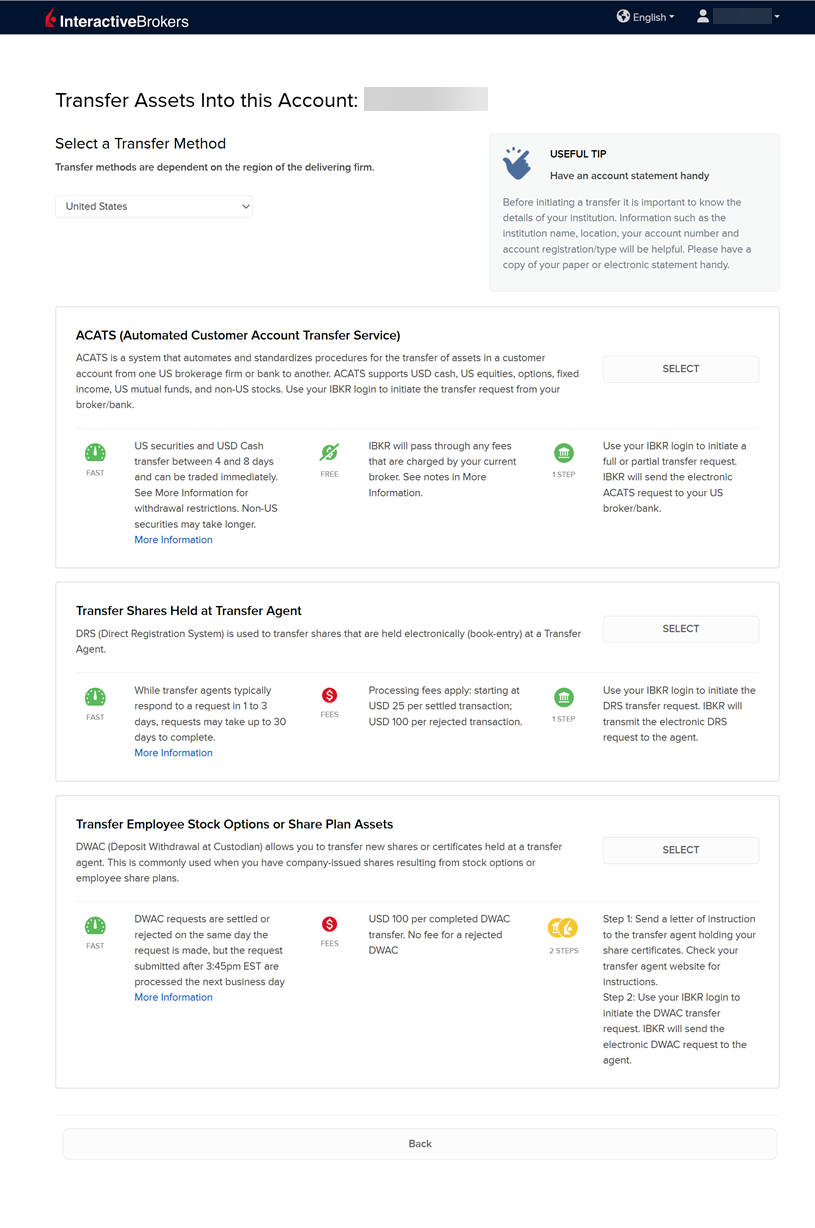

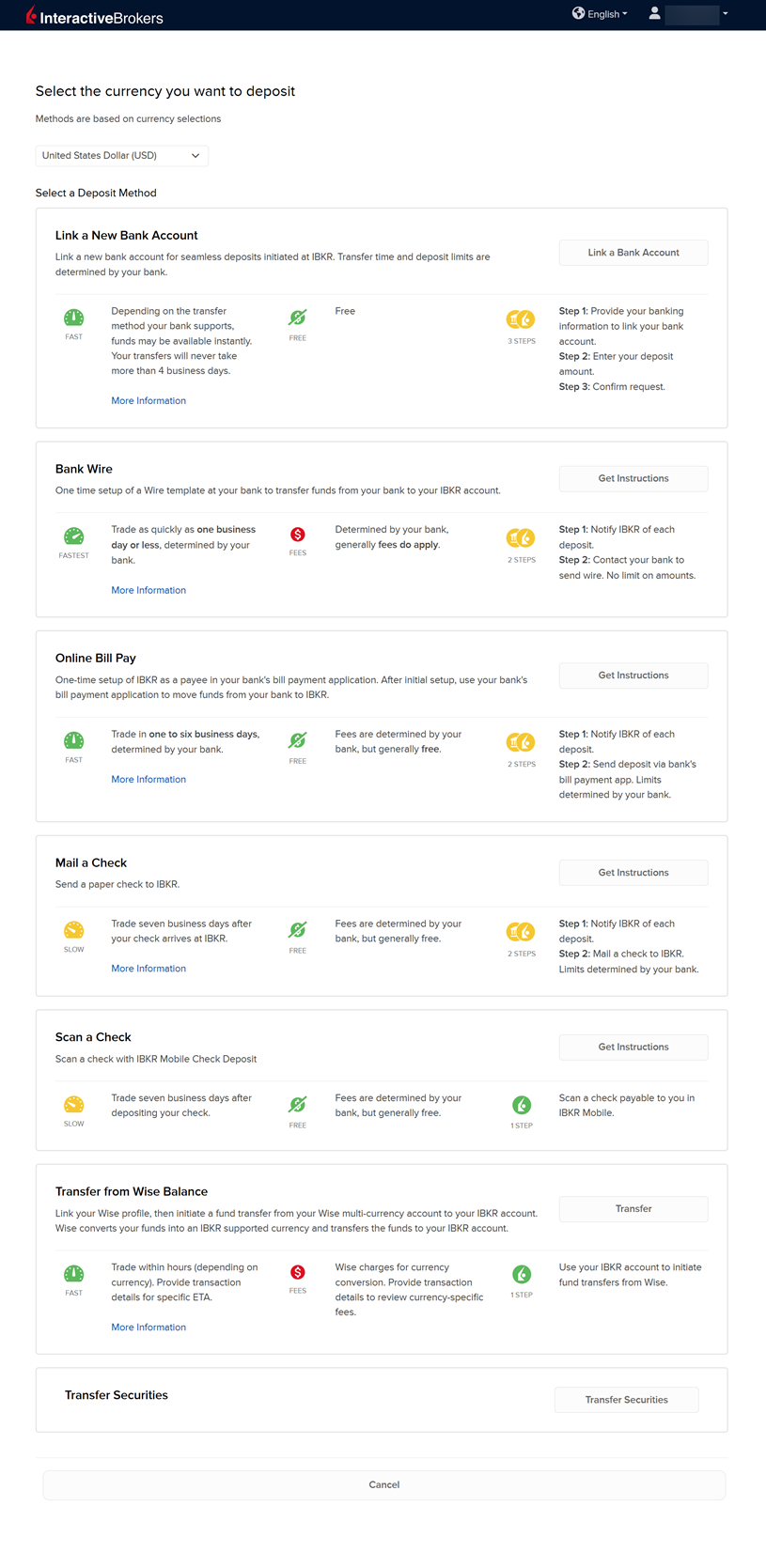

A list of transfer methods will populate on your screen. Click your desired transfer option.

-

Provide your bank details and complete the transfer request.

-

If you are looking to transfer cash and securities from your previous custodian, select the Transfer Securities button at the bottom of the page.

-

A list of transfer security methods will populate on your screen. Click your desired transfer option and provide the required custodian details.