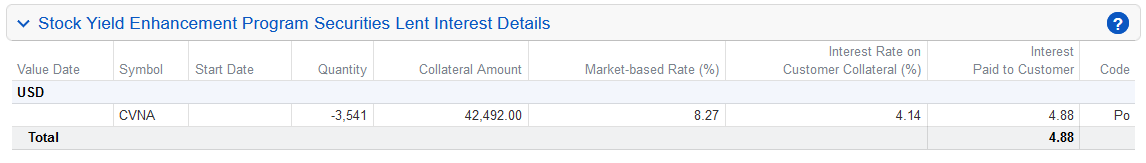

Stock Yield Enhancement Program Securities Lent Interest Details

This section for customers participating in the Stock Yield Enhancement Program shows details of interest earned on securities lent.

This section applies to statements after February 28, 2017.

This section appears in the Default Statement and Legacy Full Default Statement.

| Column | Description |

|---|---|

| Value Date | The date used to determine income. |

| Symbol | The symbol of the security lent. |

| Start Date | Start date of the loan. |

| Quantity | The number of shares lent. |

| Collateral Amount | The collateral amount securing the loan. |

| Market-based Rate (%) | The market-based interest rate on Value Date. |

| Interest Rate on Customer Collateral (%) | The net interest rate applied to the collateral amount. |

| Interest Paid to Customer | The amount you receive for lending IBKR your fully-paid shares. |

| Code | The code abbreviation. |

Totals

Total amounts for the following fields appear at the bottom of each currency section:

- Interest Paid to Customer

Shows the income received on an individual loan basis including the security, quantity lent, collateral amount, the market-based rate and the interest amount paid to the account. Interest Paid to Customer is calculated by multiplying the Collateral Amount by the Interest Rate on Customer Collateral and dividing by 360 days.

This section will only be displayed if the interest accrual earned by the client exceeds USD 1 for the statement period.