Version 0.07: MultiSort Screeners, Option Lattice, Option Analysis

Version 0.07 of IBKR Desktop includes the following enhancements:

MultiSort Screeners

MultiSort Screeners enable users to find and sort data using multiple factors simultaneously. This is essential for traders and investors who need to evaluate diverse information, such as fundamental data, past performance, and technical indicators. MultiSort makes it easy to input multiple preferences, and quickly returns the most relevant results.

Choose up to 10 sort factors, and use the up/down arrows to specify whether a lower or higher value is most desirable. For example, you might want to see stocks with high dividend yield but low P/E ratio.

Once you have selected the factors on which to sort your screener, you can specify the "Importance" level of each factor. By default each is set to Important, but you can modify to be "Somewhat Important" or Very Important." Use the "!" icons to set levels of importance.

! = Somewhat Important

!! = Important (default)

!!! = Very Important

As you modify factors, the screener updates in real time.

To create a MultiSort Screener

-

Select Screeners from the left navigation panel.

-

In the Screener Type panel, click MultiSort.

-

From the Filters box, select up to 10 factors. Use the DOWN arrow selector to indicate lower values are prioritized. Use the UP arrow to prioritize higher values. Close the Filters box after all desired factors have been selected.

-

In the factor list, modify "Importance" if desired by clicking the exclamation point icon in the factor description.

Add factors at any time by clicking "Add sort factors" at the bottom of the factors list.

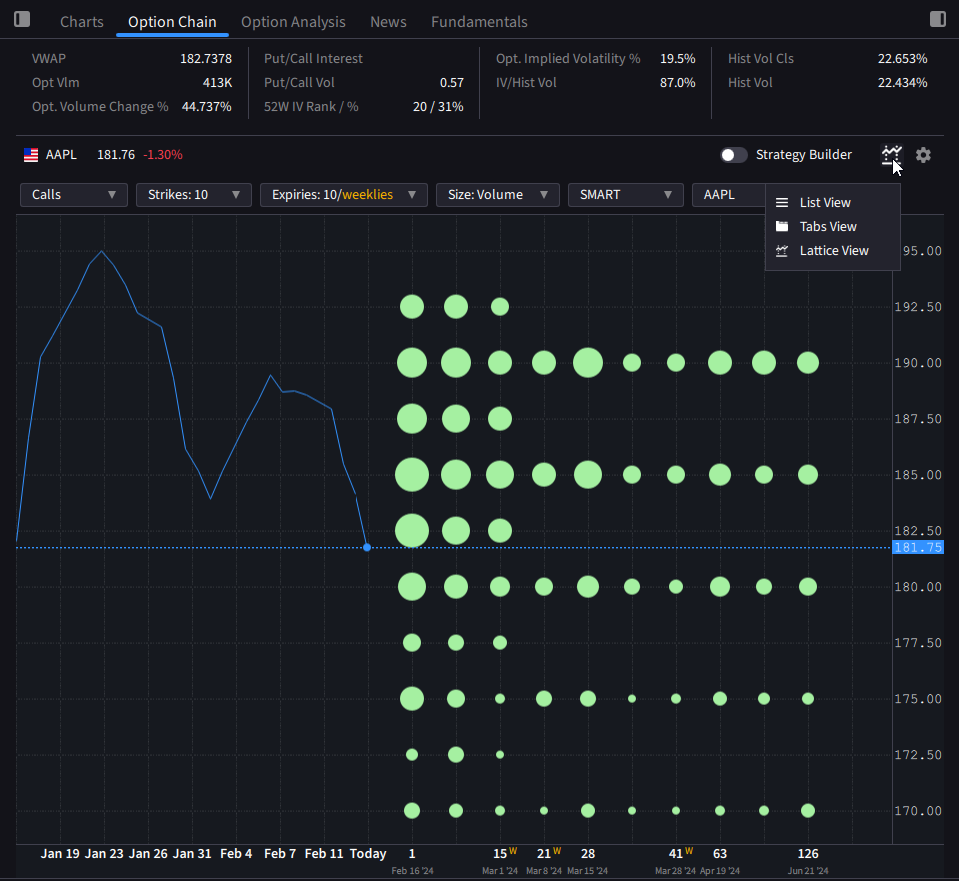

Option Lattice

Option Lattice, a graphical options chain display highlighting potential outliers in key metrics like Implied Volatility, Open Interest, Volume, or Last Price, allows users to easily compare option contract metrics across expiry dates.

To view the Option Lattice

-

From the left navigation panel, click the Quote icon.

-

From the tabset along the top of the page, select Option Chain.

-

Click the View icon to the left of the gear icon, and select Lattice View.

-

Modify display attributes like Calls/Puts, number of strikes, number of expiries, key metric (volume, open interest, last, implied volatility) and more.

Turn on the Strategy Builder to create calendar and other spreads.

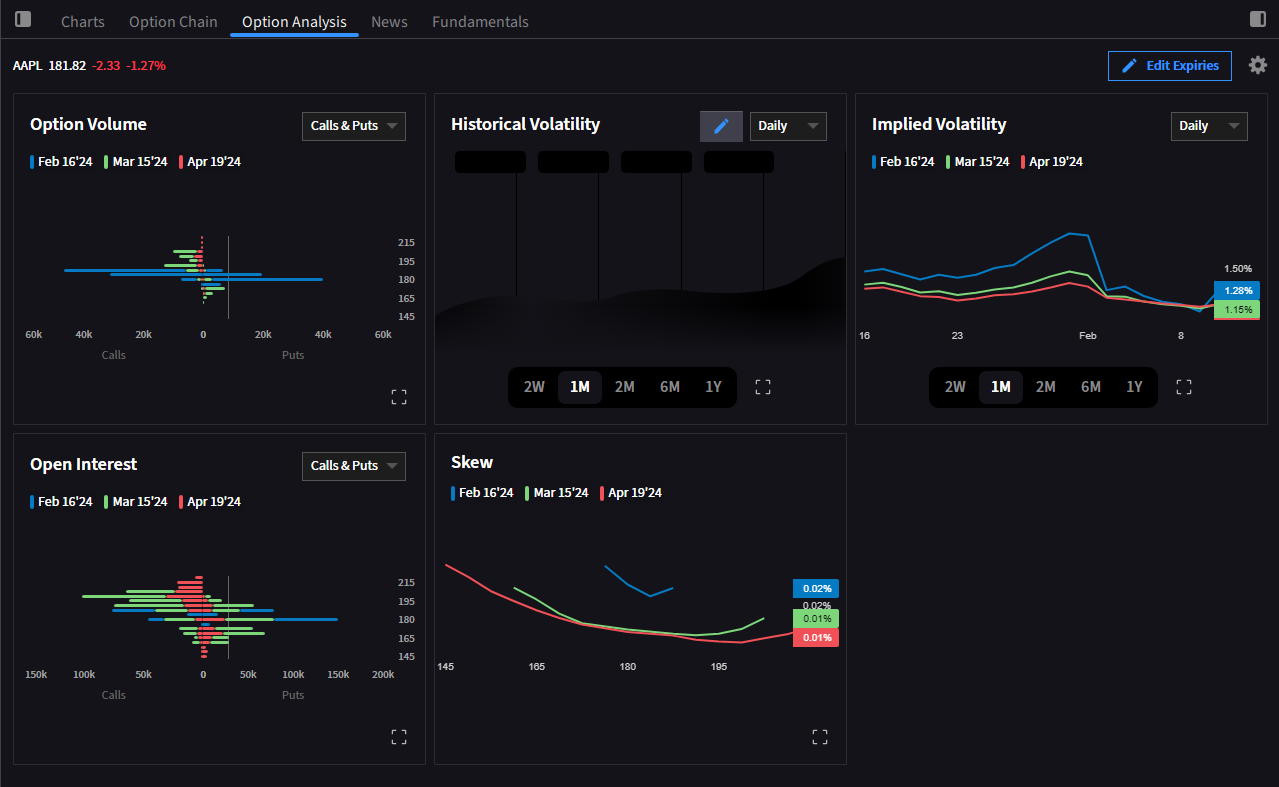

Options Analysis

Options Analysis provides a visual and editable in-depth analysis of a single underlying across key metrics including Option Volume, Historical Volatility, Implied Volatility, Open Interest, and Skew.

To open Options Analysis

-

From the left navigation panel, click the Quote icon.

-

From the tabset along the top of the page, select Option Analysis.

Edit Expiries for all metrics in the top right corner. Modify other metrics as applicable. Add, remove, and rearrange metrics displays using the gear icon in the top right corner to Customize Layout.

Other

-

Flash table cells on each tick: Turn on in Settings. From the Display page turn animation feature on/off.