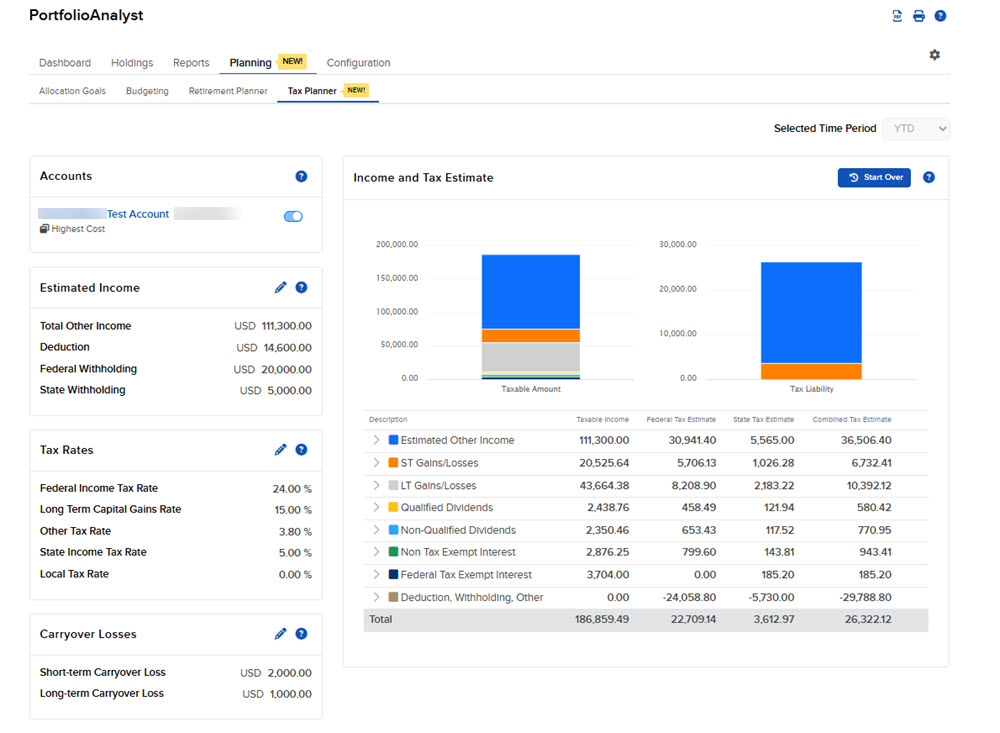

Tax Planner

The Tax Planner in PortfolioAnalyst is a tool to help you estimate taxes for your brokerage account(s) activity. This tool allows you to choose the desired investment accounts to include, and utilizes taxable income sources outside of your investment accounts. You may customize the various tax rates used to determine your tax estimate, and view your total estimated tax and combined income sources subject to taxation.

To navigate to Tax Planner:

-

Select the Planning tab at the top of the PortfolioAnalyst page.

-

Select Tax Planner.

-

Press Continue.

-

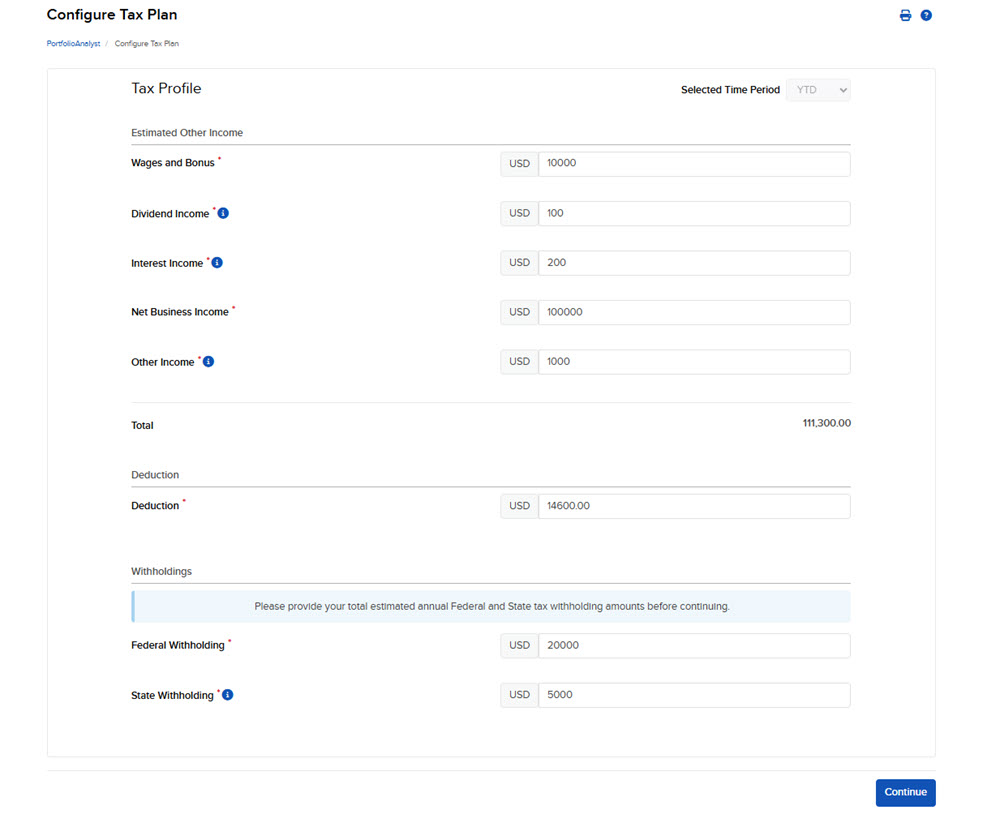

Configure your tax plan by completing the fields presented on the screen. Click Continue.

-

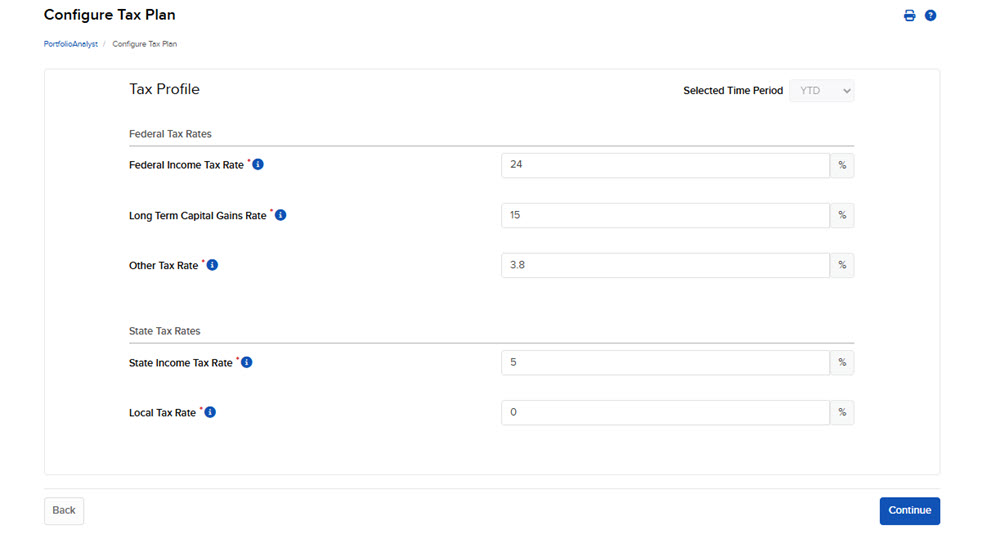

Enter the Federal Tax Rates & State Tax Rates and click Continue.

-

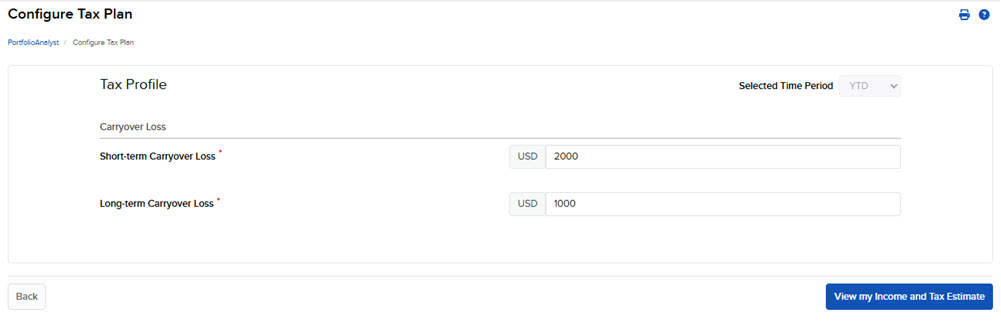

Enter Carryover loss information and click View my Income and Tax Estimate.

-

The Tax Planner page will open. Select the Pencil icon in the top right corner of any fields you would like to edit.

-

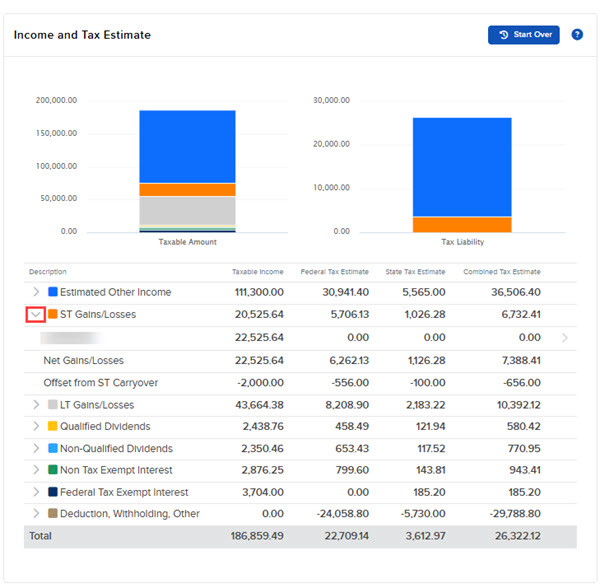

Click the drop-down menus in the Income and Tax Estimate section to view additional information.

-

Click Start Over if you'd like to restart.