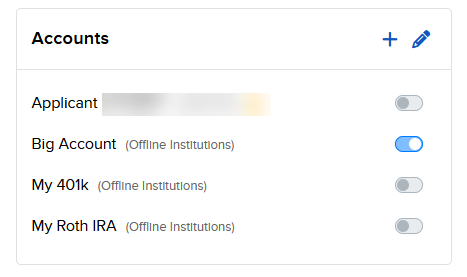

Accounts

Instructions

You can add a range of external accounts to Retirement Planner, including brokerage, bank, real estate and other asset types. To add an account, follow the steps below.

-

Click the plus (+) icon to the right of Accounts.

-

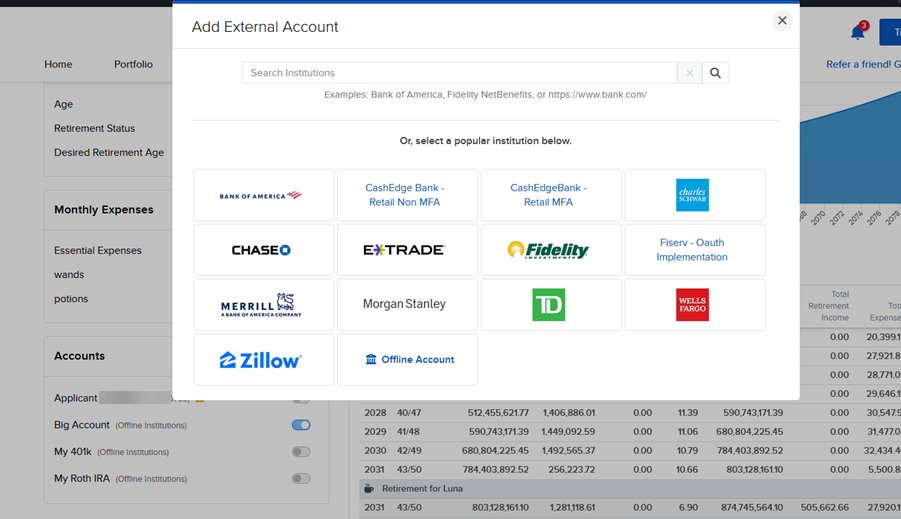

The Add External Account screen will populate. Select or search for your institution.

-

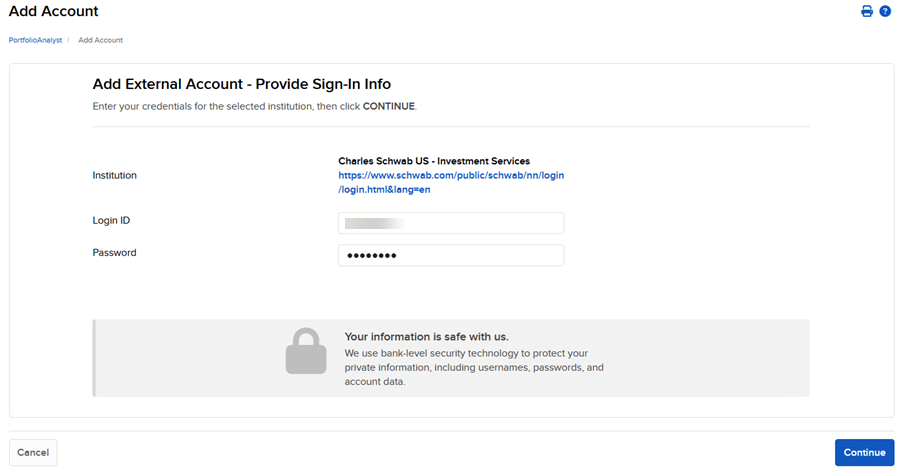

Enter your login credentials for that account.

-

The account will populate in the Accounts section.

-

Select the pencil edit icon to add information.

-

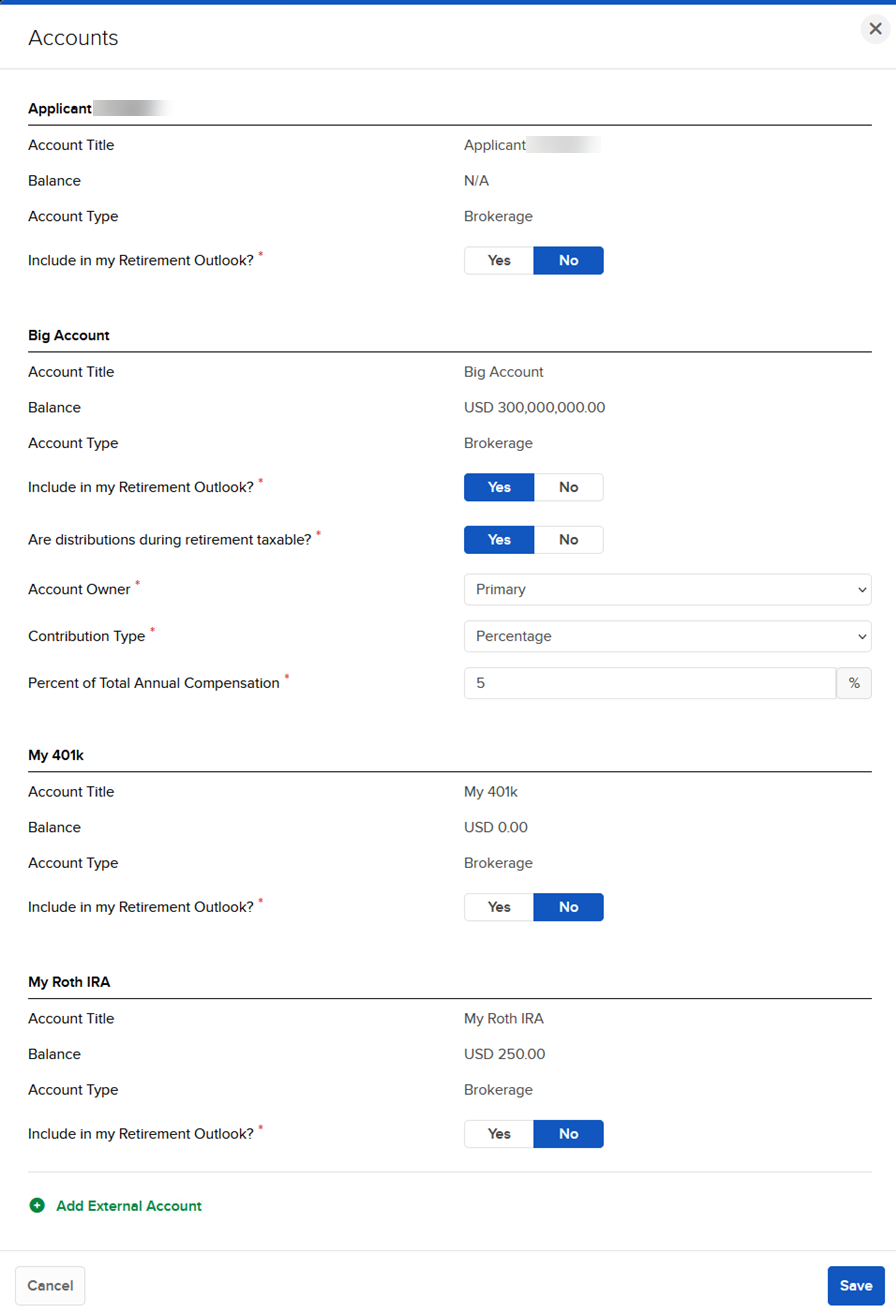

If you select Yes to Include in my Retirement Outlook, you will be prompted with additional questions.

Brokerage Accounts -

- Are distributions during retirement taxable? - We ask this to determine whether or not to deduct taxes from distribution during your retirement.

-

Contribution Type - We ask this to determine how you will be contributing to the account before retirement.

-

Amount - Annual Contribution Amount - The amount you will contribute annually.

-

Percent - Percent of Total Annual Compensation - The percentage of your compensation to be contributed.

-

Bank Accounts

- Are distributions during retirement taxable? - We ask this to determine whether or not to deduct taxes from distribution during your retirement.

-

Contribution Type - We ask this question to determine how you will be contributing to the account before retirement.

- Amount- Annual Contribution Amount - The amount you will be contributing to the account annually.

-

Percent - Percent of Total Annual Compensation - The percentage of your compensation that will be contributed.

-

Interest Rate- We ask this to determine the interest your checking or savings account receives so we can project its growth throughout the plan.

Real Estate and Other Asset Accounts

- Expected Average Annual Appreciation- We ask this to determine the average annual appreciation or depreciation you can would expect to see for your Other Asset account.

-

How will you utilize this asset?

-

Sell the asset

-

Monthly expense adjustment as a result of the sale. We ask this to determine how your expenses will be impacted at the time of the sale.

-

-

Take a loan against the asset

-

Loan amount as a percent of the asset value. We ask this to determine how large a loan you would like to take against the asset.

-

Monthly expense adjustment as a result of the sale. We ask this to determine how your expenses will be impacted at the time of the sale.

-

-

-

Liquidate Last- You can designate only one of your Other Asset accounts to liquidate last. It will be utilized after all other accounts have been tapped.

-

Press Save to save the External Account information.