Automatic Forex Swap

OVERVIEW

In general, interest on account balances are credited/debited at benchmark rates plus/minus a spread as shown on our web pages. For qualified clients with substantial forex positions, however, we have created a mechanism to carry large gross FX positions with higher efficiency with respect to carrying costs. We refer to it as the “auto swap program”. The design allows clients to benefit from our participation in the interbank forex swaps market where implied interest rate spreads are usually much narrower than the spreads available in the retail deposit market.

a. Concept

Interest is charged on settled balances, so the intent of a Forex swap as used here is to defer the settlement of a currency position from one day to the next business day. This is done by a simultaneous sell and buy of the same amount of base (first) currency but for two different value dates e.g. on T you go long 10 mio. EUR.USD for value date T+2. By example, on T+1 the position is swapped T+2 to T+3, here a sell of 10 mio EUR.USD for T+2 and a purchase of 10 mio. EUR.USD for T+3. As a result you have deferred settlement from T+2 to T+3, with the difference in prices of the two trades representing the financing cost from T+2 to T+3.

b. Cost

This service is provided as a free service and no commission or markup is charged by us. The interbank market bid/ask spread inherent in the swap prices may be regarded as a cost but is not determined by us. We provide the service on a best efforts basis to our large Forex clients.

c. Position Criteria

Swap activity is only applied to accounts with gross FX positions larger than 10 mio. USD or approximate equivalent of other currencies. Positions are swapped (rolled) in increments or multiples of USD 1 mio. (or equivalent). The residual settled balances are traded under our standard interest model1. Positions that are swapped (rolled) are real positions, i.e. the projected T+1 settled cash balances.

The so-called “Virtual Positions” are not considered; the virtual position is only a representation of the original trades expressed as currency pairs, for example EUR.CHF.

Settled cash balances are a single currency concept, e.g. EUR or CNH. We execute all swaps against USD as it is the most efficient funding currency. Should you have a position in a cross, e.g. EUR against CHF, two swaps, one in EUR.USD and one in USD.CHF will be done. The threshold(s) and increment(s) may change at any time without notice.

d. Client Eligibility

As we offer this service for free, only clients with substantial currency positions are eligible for inclusion in the service. US legal residents need to be an Eligible Contract Participant (ECP) and be in the possession of an LEI number (legal entity identifier). We cannot guarantee a client’s inclusion in the program and all inquiries require compliance approval prior to become active2.

e. Swap Price Recognition

We may conduct a series of swaps in a currency during a day. We will use average bid and ask prices at which it executed, respectively average bid and asks as quoted in the interbank market. Swap prices are not published but can be seen (or calculated) in the statement after execution. The swaps are applied in the account at the end of the day.

f. Recognition in the Statement

You will find the swap transaction(s) in the Trades section of the statement. The swap are represented as simultaneous purchase/sale or vice versa, do not have a time stamp and shows an M (manual entry) in the code column. The actual swap prices are the difference in between the two prices.

Here an example for cob 20150203 that shows a swap from 20150203 to 20150204.

g. Examples of Swap Prices

Here a couple of examples that use swap prices from a major interbank provider. Often bid/ask spreads are even tighter.

| Currency Pair | Spot Bid | Spot Ask | Tenor | Days in Period (TN) | Swap Points Bid | Swap Points Ask | Implied Currency | Implied Rate Bid | Implied Rate Ask |

|---|---|---|---|---|---|---|---|---|---|

| EUR.USD | 1.04481 | 1.04483 | TomNext(TN) | 1 | 0.00004220 | 0.00004280 | EUR | -0.77% | -0.75% |

| USD.HKD | 7.76810 | 7.76810 | TomNext(TN) | 1 | -0.00011500 | -0.00011000 | HKD | 0.17% | 0.19% |

| USD.JPY | 117.050 | 117.052 | TomNext(TN) | 1 | -0.0038 | -0.0032 | JPY | -0.47% | -0.47% |

| USD.CNH | 6.93101 | 6.93105 | TomNext(TN) | 1 | 0.0021 | 0.0028 | CNH | 11.77% | 15.46% |

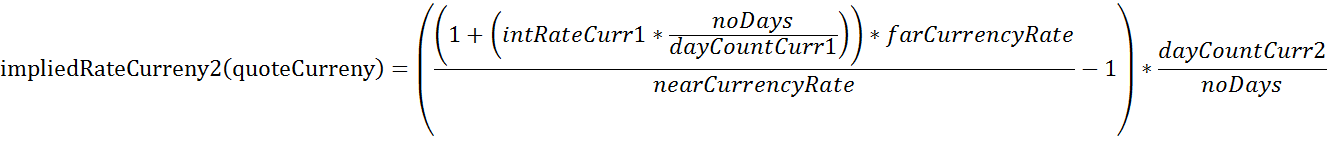

In more detail, let’s assume you want to calculate the implied CNH rate resulting from a USD.CNH swap. We are looking for the implied rate of the quote currency CNH (Currency 2). Therefore the following formula is used:

| Description | Variable | Value |

|---|---|---|

| Currency Pair (Currency1.Currency2) | USD.CNH | |

| day count convention Currency 1 (base Currency), i.e. USD | dayCountCurr1 | 360 |

| day count convention Currency 2 (quote Currency), i.e. CNH | dayCountCurr2 | 360 |

| Tenor | TomNext | |

| number of days in the Tenor | noDays | 1 |

| interest rate of Currency 1 (in decimals, i.e. 1% = 0.01) | inRateCurr1 | 0.0070 |

| Currency rate (Spot) | currencyRate | 6.939500 |

| swap Points expressed in decimals | swapPoints | 0.0012 |

| near Currency Rate (Spot - swap points) | nearCurrencyRate | 6.938300 |

| far Currency Rate (in a Tomnext swap this is the spot rate) | farCurrencyRate | 6.939500 |

| implied interes rate of Currency2, i.e. CNH | impliedRateCurrncy2(quoteCurrency) | 0.0692 |

So using above figures, this results in a 6.92% implied interest rate for CNH.

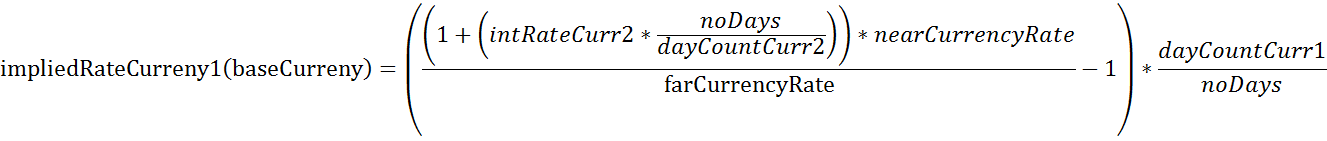

Now if you wanted to calculate the implied rate for the base currency (Currency 1) the formula would change slightly. Here an example using EUR.USD:

| Description | Variable | Value |

|---|---|---|

| Currency Pair (Currency1.Currency2) | EUR.USD | |

| day count convention Currency 1 (base Currency), i.e. EUR | dayCountCurr1 | 360 |

| day count convention Currency 2 (quote Currency), i.e. USD | dayCountCurr2 | 365 |

| Tenor | TomNext | |

| number of days in the Tenor | noDays | 1 |

| interest rate of Currency 2 (in decimals, i.e. 1% = 0.01) | inRateCurr2 | 0.0070 |

| Currency rate (Spot) | currencyRate | 1.039900 |

| swap Points expressed in decimals | swapPoints | 0.000042 |

| near Currency Rate (Spot - swap points) | nearCurrencyRate | 1.039858 |

| far Currency Rate (in a Tomnext swap this is the spot rate) | farCurrencyRate | 1.039900 |

| implied interes rate of Currency1, i.e. EUR | impliedRateCurrncy2(baseCurrency) | -0.0075 |

Using above example, this results in a -0.75 % implied interest rate for EUR.

1For example, in the case of a USD 20.3 mio. position only 20 mio. will be swapped. USD 0.3 remains in the account and interest using benchmark and spreads will be applied. A USD 300k position will not be considered for swapping at all. The position by currency is taken as the reference, regardless of the overall position.

2US, Australian and Israeli domiciled residents are currently not eligible for inclusion in the Automated Forex Swap Program.