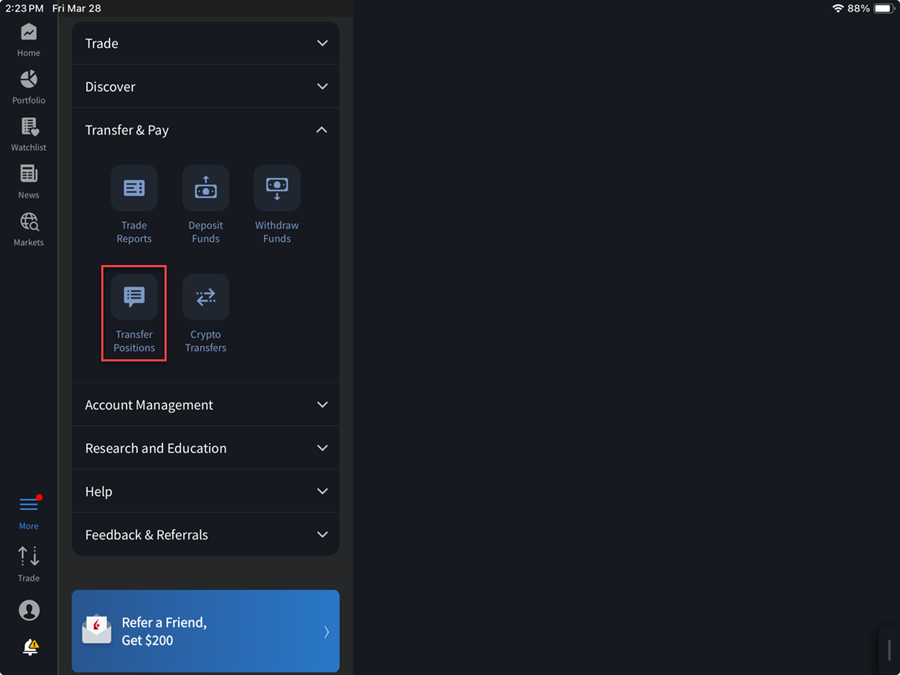

Transfer & Pay

Instructions

This section describes how to use the funding functions in IBKR Mobile for the iPad. Transfer & Pay lets you check the status of your deposits, transfers and withdrawals; enter deposit notifications and set up withdrawals; create bank instructions for fund and position transfers, settlement instructions for cash and position transactions, and recurring instructions for recurring transactions.

To navigate to this page, please take the steps outlined below.

-

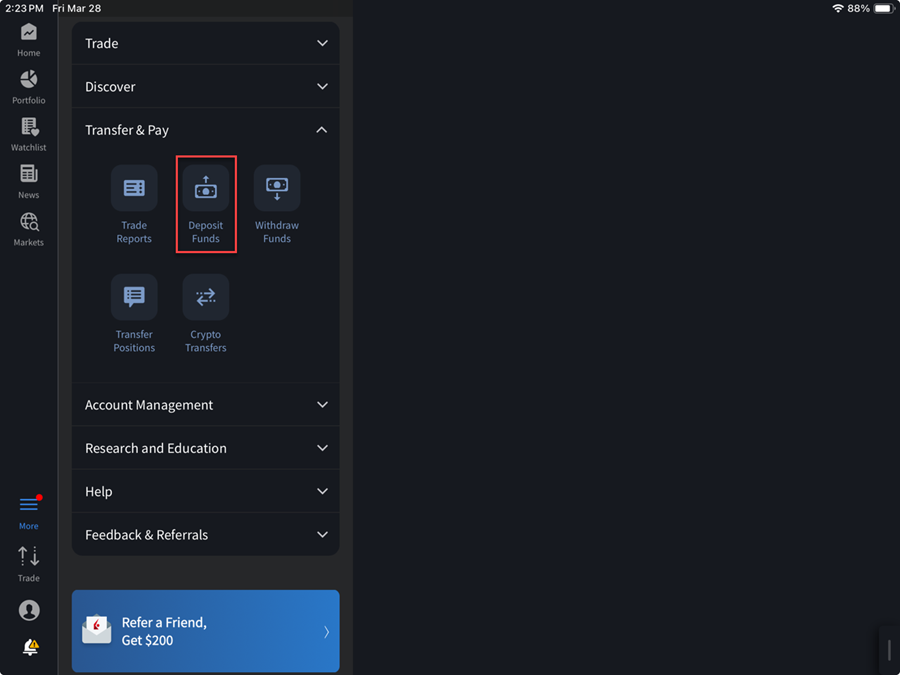

Tap the More icon and tap Transfer & Pay

-

Deposit Funds

Deposit Funds

-

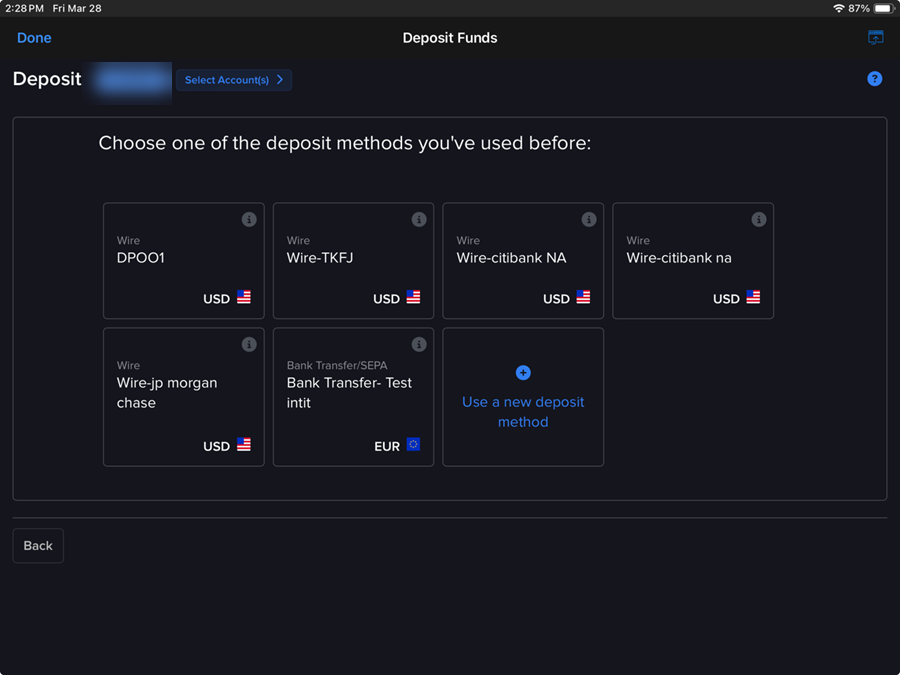

Tap the Deposit Funds button.

-

Select a deposit method you have used before or use a new deposit method to initiate a deposit notification.

-

We support the following types of deposit notifications:

- Wire - Same day electronic movement of funds through the fed wire system. You must contact your bank to initiate a wire and include your account name and number on the wire. Specific wire instructions and addresses will be displayed during the deposit process. Wire deposits arrive immediately to four business days, depending on your bank. Non-U.S. banks are generally at the longer end of the range. Credit to account is immediate upon arrival.

- ACH - Your transfer request will automatically be processed through a message sent to your bank by IB. Prior to using this method, you will need to create a standing instruction through Transfer & Pay which authorizes IB and your bank to electronically transfer funds between the two accounts. You will then be prompted to verify a series of test transactions issued to your bank account several days later to establish the link. Once established, this transfer method can be used for future deposit and withdrawal requests.

- Bill Pay (online bill payment check) - A check or electronic fund transfer that originates from an online payment service provided by your Infinancial institution. For US checks, you add us to your personal payee list and your bank mails a check for you. For electronic fund transfers, you select us from your bank's list of merchants and your bank sends an electronic payment. Electronic fund transfers are credited to your account immediately. US checks will be credited to your account after seven business days.

- Transfer from Wise Balance - Link your Wise profile, then initiate a fund transfer from your Wise multi-currency account to your IBKR account.

- BPAY Notification - Online bill payment for Australian dollars only

- Wire Notification (CNH) - Chinese Renminbi only

- Wire/SEPA Notification - Euros only

- eDDA - Electronic Direct Debit Authorization. A Transfer Service in Hong Kong that provides clients with a fast and convenient way to draw funds, in HKD or CNY, from their Hong Kong bank account to credit their IBKR account. Once the initial eDDA setup request has been confirmed by your bank, you can top up your IBKR account at any time by simply confirming the transfer amount.

-

Deposit notifications are easy to complete. All required information appears as a form that you complete on a single page - as you fill in a field or make a selection, the next part of the notification form appears.

-

In the Recurring Transaction section, decide if you want to save this deposit or deposit notification as a recurring transaction.

If you would like to save this deposit notification as a recurring transaction, select the check box and complete all the fields and selections in that section, including a name for the recurring transaction, the frequency of recurrence (Monthly, Quarterly or Annually), and a Start Date. If you do not want to save this transaction as a recurring transaction, do not select the check box.

-

-

Withdraw Funds

Withdraw Funds

-

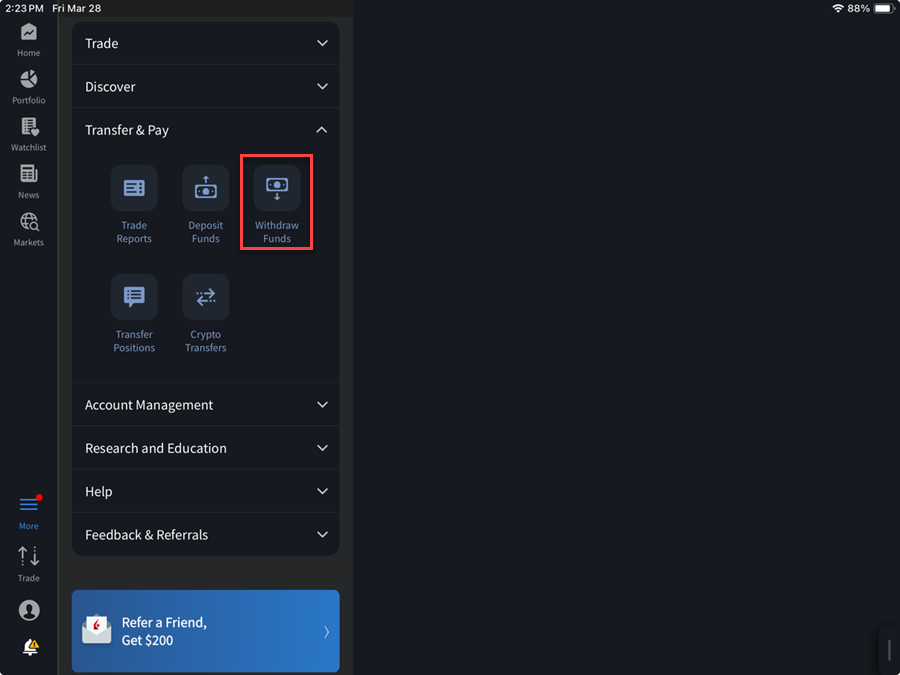

Tap the Withdraw button.

-

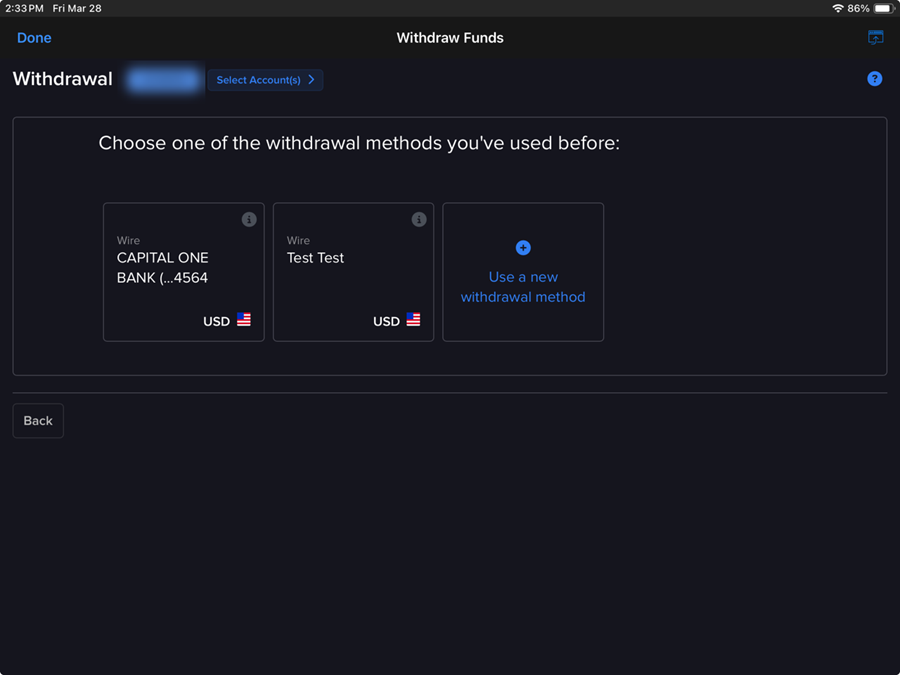

Select a withdrawal method; you can either select a previously used method or create a new withdrawal method.

-

Enter the required information depending on the withdrawal type selected to complete your withdraw.

We support the following types of withdrawal requests:

We support the following types of withdrawal requests:

-

Wire

-

ACH - US ACH transfer initiated at IBKR (US accounts only).

-

Check - Available for US currency only; your mailing address must be in the US.

-

Direct Debit - One-time setup at your bank to link your IBKR virtual account.

-

Transfer to Wise Balance - One-time setup of your Wise account as a withdrawal destination at IBKR.

-

Canadian EFT transfer - Canadian accounts only

-

SEPA (Single Euro Payments Area) Initiated at IBKR

Low-Value Payments (LVP) for:

-

GBP - BACS (Bankers' Automated Clearing Services)

-

HKD - GIRO/ACH

-

CNH - GIRO/ACH (offshore Renminbi)

-

NZD - ACH

-

SGD - GIRO/ACH

Note: Each LVP services is strictly local to the currency (i.e. BACES is for GBP accounts in the UK).

Rules for Withdrawals

Rules for Withdrawals

The following rules apply to withdrawals:

- Accounts that do not participate in our Secure Login System are limited in the amount of money that can be withdrawn. Account holders without a security device are limited to a maximum withdrawal of 50,000 USD per day and a maximum withdrawal of 100,000 USD in five business days. For more information, see Withdrawal Limits.

- Typically withdrawal requests submitted prior to the cut-off will be sent that day, under normal business circumstances; however, in certain cases a withdrawal request may be subject for further review which may result in a delay. We apologize for any inconvenience.

- There is no charge for the first withdrawal (of any kind) every 30 days; however, we will charge withdrawal fees for any subsequent withdrawal.

- All withdrawals will be sent in the name of the account holder.

-

IBKR may, from time to time, allow clients to submit withdrawal requests for settlement proceeds on the scheduled settlement date. However, please be aware that events beyond IBKR’s control may cause delays or failures in the settlement process. Such delays or failures will not automatically render the withdrawal requests void and may cause the client to incur interest charges due to an account deficit. It is the client’s responsibility to bear the interest charge if settlement does not take place on the scheduled settlement date due to events beyond IBKR’s control. IBKR, in any event, shall not be liable for any damages, whether direct, indirect, special, consequential, incidental, for any settlement that did not take place on the scheduled settlement date due to events beyond IBKR’s control.

-

-

-

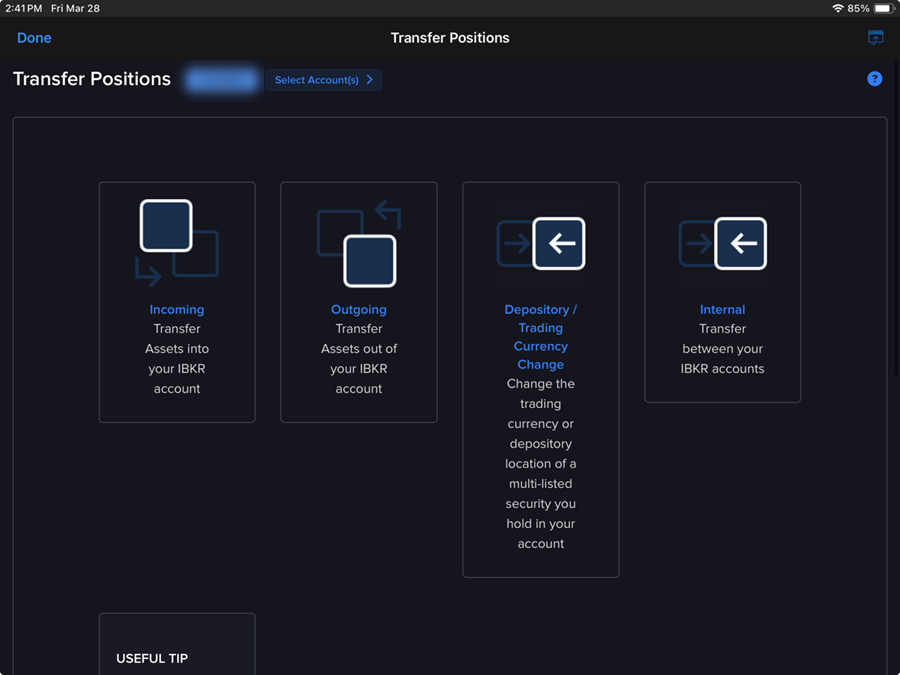

Transfer Positions

Transfer Positions

-

Tap the Transfer Positions button.

-

Select between an Inbound or Outbound transfer.

-

Inbound position transfers

- Automated Customer Account Transfer Service (ACATS)

- Account Transfer on Notification (ATON) for Canadian securities

- DRS - Transfer Shares Held at Transfer Agent

- DWAC - Deposit/Withdraw at Custodian

- Free of Payment (FOP) for US stocks

-

Free of Payment Transfer of Global Securities

- Internal Position Transfer

- Transfer Positions Between Master and Sub Accounts

-

Outbound position transfers

- DRS - Deliver Shares to the Issuer's Transfer Agent / Registrar

- DWAC - Deposit/Withdraw at Custodian

- Free of Payment Transfer of US Securities

-

Free of Payment Transfer of Global Securities

- Internal position transfers

- Position Transfer Between Master and Sub Accounts

-

-

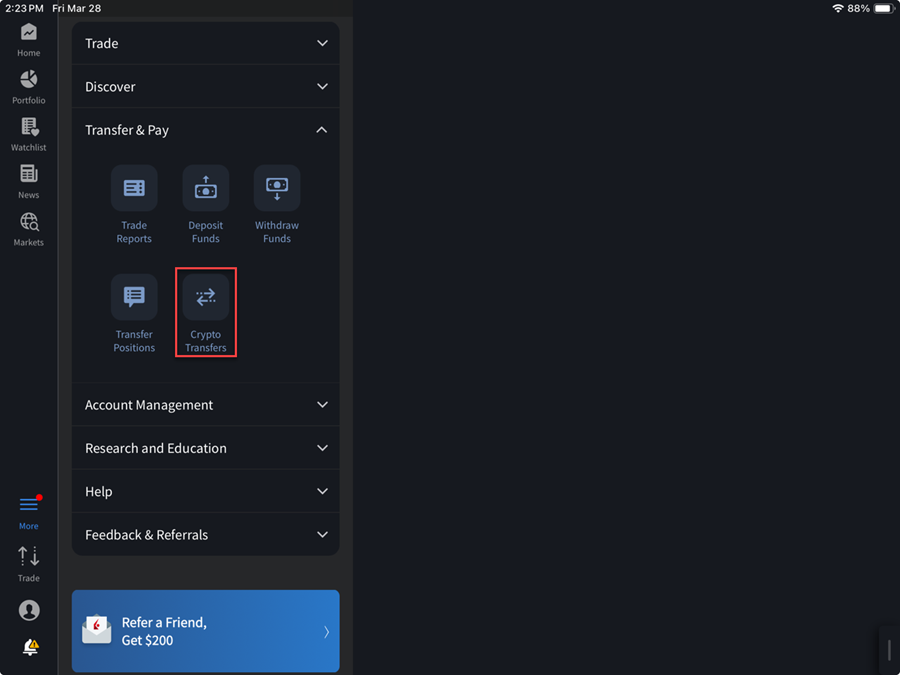

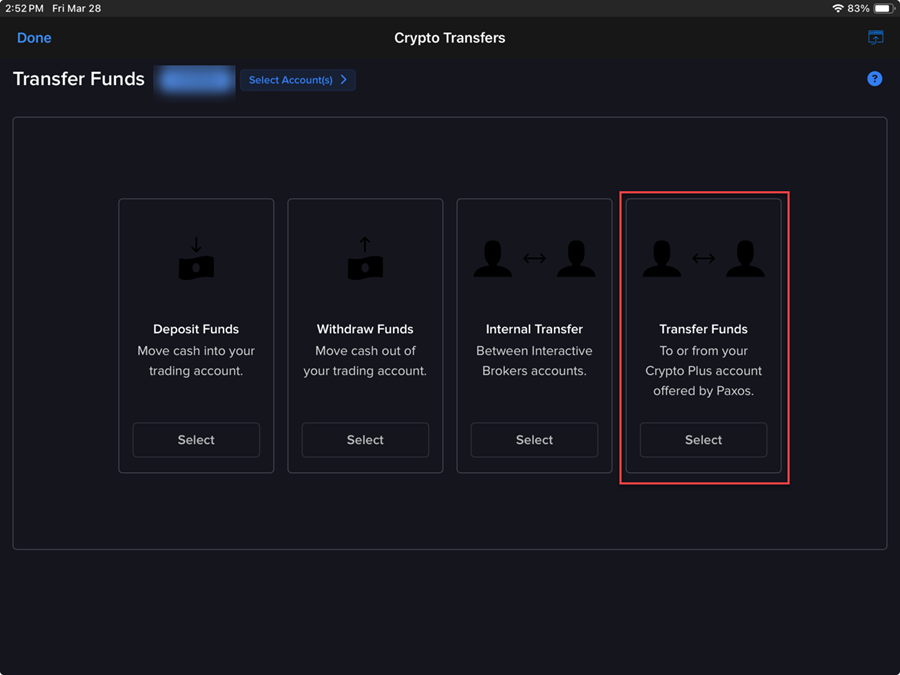

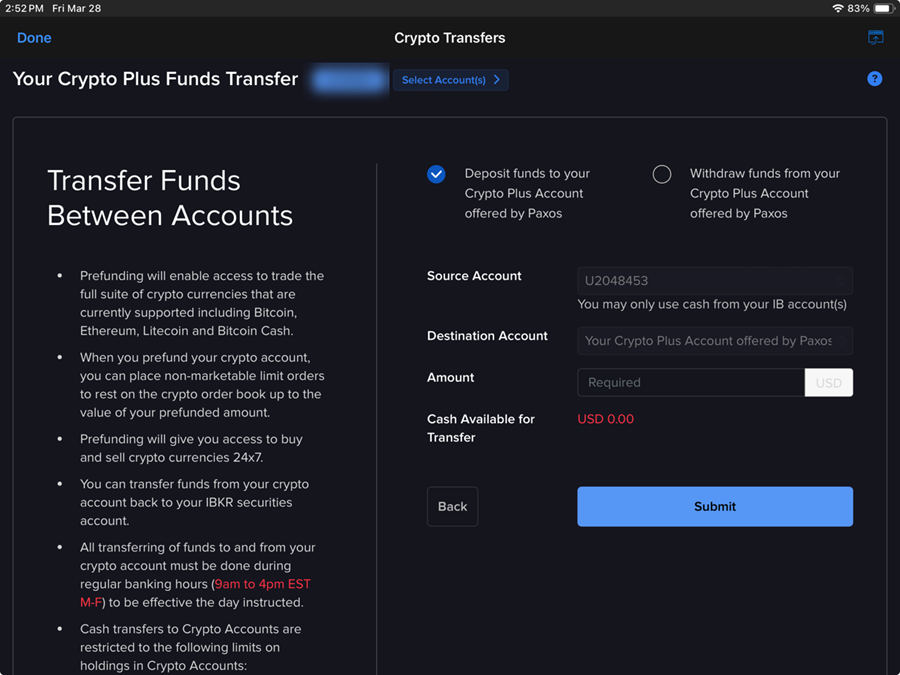

Crypto Transfer

Crypto Transfer

-

Tap the Transfer Positions button.

-

If you have not yet enrolled in Crypto Plus select Enroll in Crypto Plus.

-

Select Transfer Funds to or from your Crypto Plus account offered by Paxos.

-

In the Transfer funds to/from your crypto account section, select the account to which you want to transfer funds, and enter the amount to transfer and click Create Internal Transfer.

-

Once created you can start another transfer, view the transaction history page, or click Finish to go back to the transfer page.

-

-