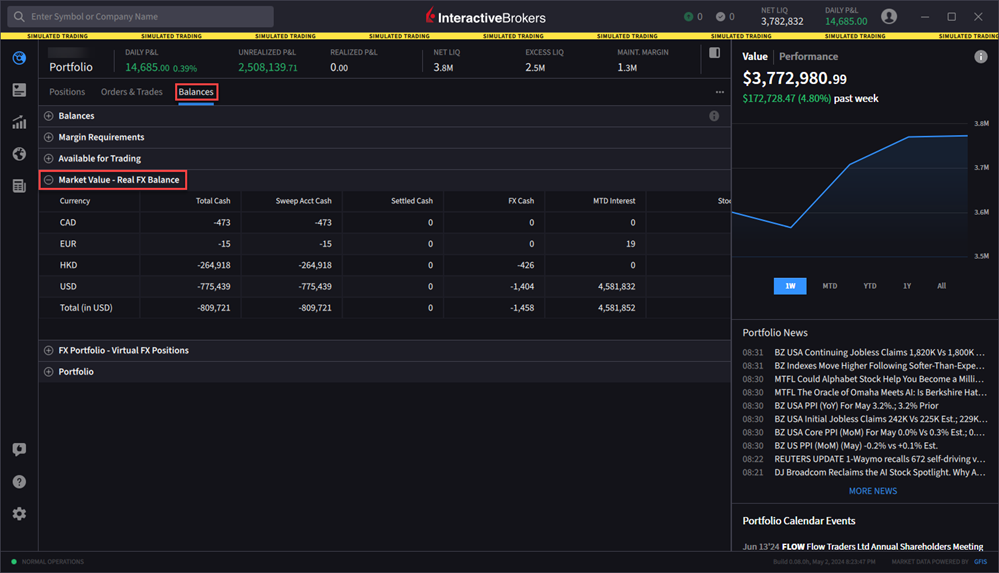

Market Value - Real FX Balance

The Market Value section shows you total value for all assets sorted by currency. Accounts with the ability to transfer between brokers will also have an "In Transit" tab to monitor DVPs and other position transfers. To view this information, please take the steps outlined below.

Instructions

-

Click the Portfolio menu

from the top left corner of your screen.

from the top left corner of your screen. -

Click the Balances tab.

-

Expand the Market Value - Real FX Balance section.

Parameter Description Currency Open positions are grouped by currency. Total Cash Cash recognized at the time of trade + futures P&L.

This value reflects real-time current FX positions, including:

-

Trades executed directly through the FX market

-

Trades executed as a result of automatic IB conversions, which occur when you trade a product in a non-base currency,

-

Trades deliberately executed to close non-base currency positions using the FXCONV destination.

Sweep Acct Cash Settled Cash Total cash that has settled + futures P&L. FX Cash MTD Interest Interest accrued month-to-date Stocks Real-time mark-to-market value of stock. Options Real-time mark-to-market value of securities options. Futures Real-time change in futures value since last settlement. FOPs Real-time mark-to-market value of futures options. Net Liquidation Value Total cash value + stock value + options value + bond value. Unrealized P&L The difference between the current market value of your open positions and the average cost, or Value - Average Cost. Realized P&L Shows your profit on closed positions, which is the difference between your entry execution cost and exit execution cost, or (execution price + commissions to open the position) - (execution price + commissions to close the position). -

There is a substantial risk of loss in foreign exchange trading. The settlement date of foreign exchange trades can vary due to time zone differences and bank holidays. When trading across foreign exchange markets, this may necessitate borrowing funds to settle foreign exchange trades. The interest rate on borrowed funds must be considered when computing the cost of trades across multiple markets.