Position Transfer Basis

Instructions

The Position Transfer Cost Basis page lets you specify the cost basis for positions transferred into your account using ACATS (Automated Client Account Transfer Service), ATON (Account Transfer Online Notification), or FOP (Free of Payment). Under the FIFO cost basis accounting method, a closing transaction is matched with the cost basis of the earliest transaction in the position to determine realized profit or loss. The FIFO cost basis method is used throughout the US for stocks, security options, single stock futures and Forex.

-

Click Performance & Reports > Tax Documents.

-

Alternatively, click Menu in the top left corner > Reporting > Tax Documents.

-

-

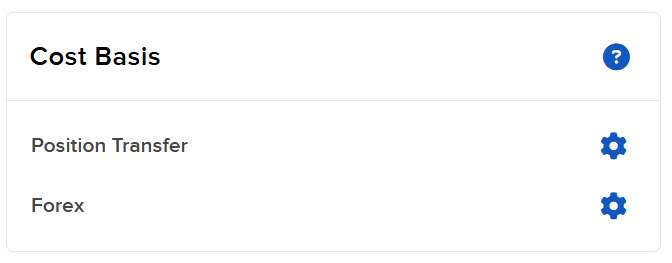

In the Cost Basis Panel, click the Configure (gear) icon to the right of Position Transfer.

The Position Transfer Cost Basis screen opens.

If there are no eligible transactions, there is nothing for you to do and you can exit this screen using the menu or breadcrumbs.

-

If there are eligible transactions, select a transfer date.

-

In the Edit Positions section, update the cost basis for ACATS, ATON or FOP transfers as described below:

-

Enter the number of shares or contracts for the position in the Quantity field.

-

Enter the date of purchase for the position in the Acquisition Date field.

-

Enter the total cost basis for the entire position in the Total Cost field.

- Select a currency for the position. Available currencies are the asset trading currency, your base currency and USD. For new tax lots, the asset trading currency, displayed on the symbol row, is the default. For old tax lots that may not have a currency, USD is the default.

-

Optionally add a new tax lot by clicking Add Lot in the Action column.

-

Optionally delete a tax lot by clicking Delete in the Action column.

-

-

Click Continue to submit your cost basis update.