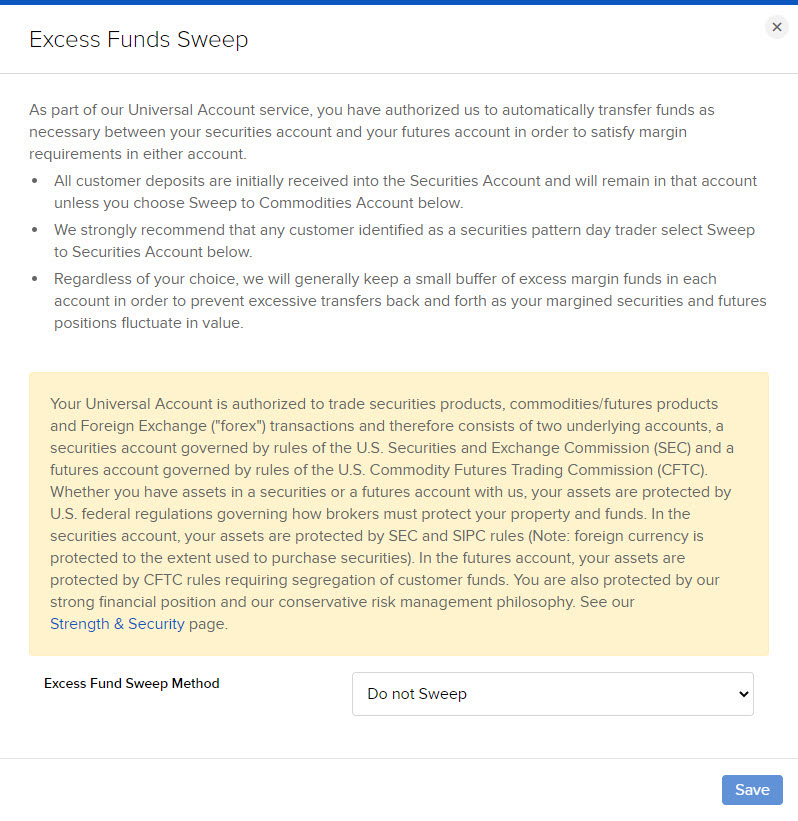

Excess Funds Sweep

Instructions

A ccounts can be authorized to trade both securities products and commodities/futures products. Each account will therefore consist of two underlying accounts or account segments: a securities account governed by the rules of the U.S. Securities and Exchange Commission (SEC) and a futures account governed by the rules of the U.S. Commodity Futures Trading Commission (CFTC). As part of the service, you have authorized us to automatically transfer funds as necessary between the securities account and the futures account in order to satisfy margin requirements of either.

Use the Excess Funds Sweep page to configure how you want us to handle the transfer of excess funds between the two underlying accounts. You can choose to sweep the funds to either the securities account or the commodities account, or choose not to sweep funds at all.

Note the following:

- All client deposits are initially received into your securities account. They will remain in that account unless you choose to sweep excess funds to the commodities account.

- If the account holder is identified as a securities pattern day trader, we strongly recommend that you choose to sweep excess funds into the securities account.

- Regardless of your choice, we will generally keep a small buffer of excess margin funds in each account, to prevent excessive transfers back and forth as margined securities and futures positions fluctuate in value.

- This feature is not available in IB-India and IB-UKL accounts.

Set Your Excess Funds Sweep Method

-

From the contact information page select Excess Funds Sweep.

-

Read the important information on the page, then select a sweep method from the drop-down menu:

-

Do not sweep excess funds

-

Sweep excess funds into my securities account

-

Sweep excess funds into my commodities account

-

-

Click Save. The setting is saved immediately.