Commission Markups

Instructions

You can charge your clients for services rendered based on a fee-per-trade unit for each asset class (e.g. stocks, options, etc.), exchange and currency. The trade unit is determined by the unit IBKR uses for its commissions charges and can be on a per share, per contract, or % of trade value basis. To specify commission markups, follow the steps below.

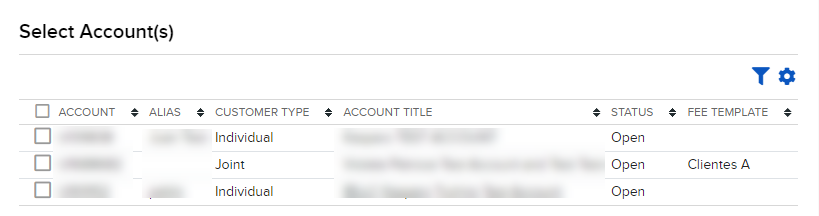

- Click Menu in the top left corner > Administration & Tools > Fees & Invoicing > Fees

- The display selector will open on the right side.

- To sort the list by any column heading, click the arrow next to that heading.

- Select an account you'd like to add a markup to.

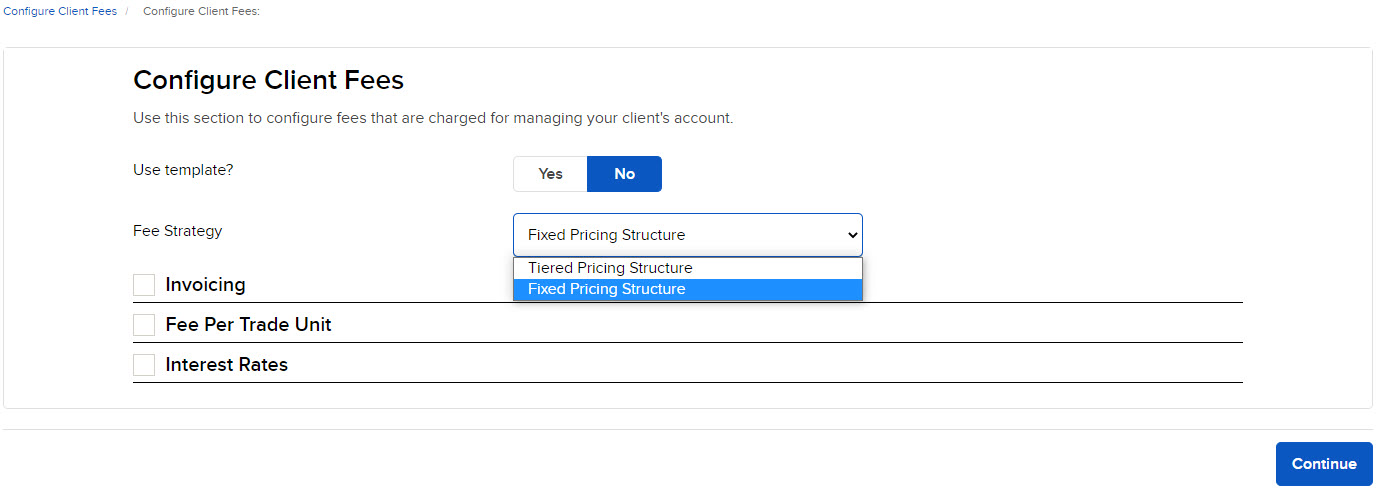

- Select a Client Fee Template if you wish to use one.

-

Select the Fee Strategy from the drop-down

-

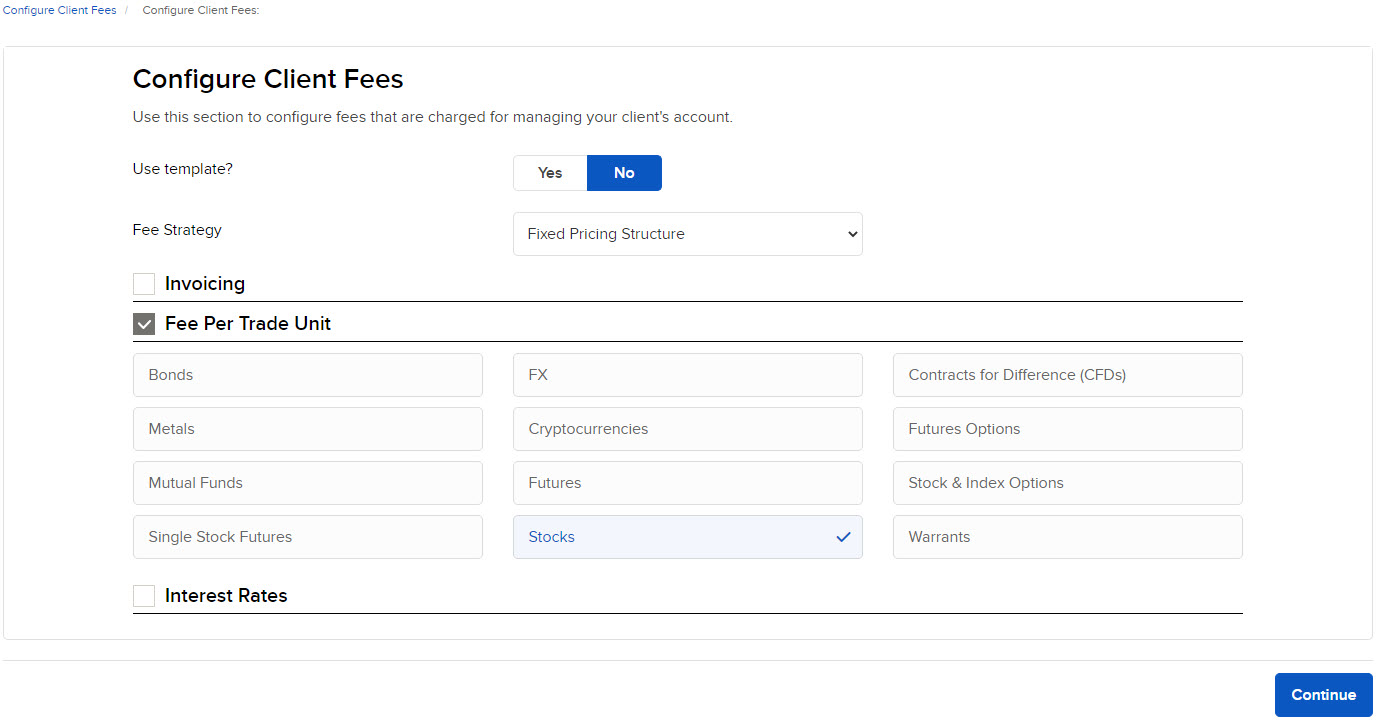

Select the Fee Per Trade Unit check box and the products you would like to mark up.

After selecting the product listed in the screenshot below, an additional pop-up menu may appear allowing you to select Currency, Exchange, and Product (Ticker Symbol).

Note: When making the selections for Currency, Exchanges, and Product, please be aware that the Products field supersedes the Exchange field, while the Exchange field supersedes the Currency field.

Note: When charging a markup on FX products, the commission is based on the second currency in the FX pair. For example, if a client trades in EUR.USD, the markup is based on USD, not EUR.

-

Press Continue

-

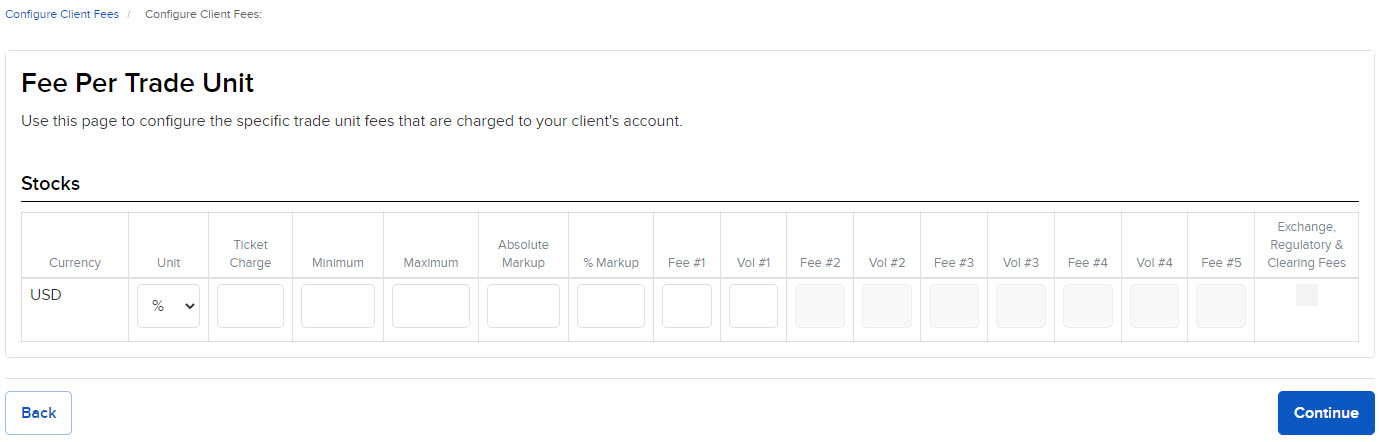

Configure the specific trade unit fees. For more information on this, click here.

Note: The unit can be based either on Shares or % of notional trade value. If, for example, you select % then enter 0.15 in the Absolute Markup column for USD stocks, the markup will add 0.15% of the trade value on top of IBKR’s commissions. The minimum column however will still be entered as a dollar amount.

The Fee # and Volume columns are per trade tier (not per month). -

Press Continue to review, then Save.

The following general rules apply to broker client fee schedules:

- If a broker has not created a fee schedule for an individual account, the default client fee template will automatically apply to that account.

- If a broker has not created either a client fee template or fee schedules for individual accounts, our standard commissions will be charged with no markup for the broker.

- Broker client markups are limited to 15 times our standard commissions.

- No fee per trade will be applied if a client calls us to close a trade.

- The Absolute Markup column is a specific amount that will be added on top of the IBKR commission.

- Brokers can only specify fees per trade for specific products and exchanges in the global fees schedule.

- For the Forex fee per trade unit, the markup is calculated on the second currency of an FX pair. For example, if a client trades in EUR.USD, the markup is based on USD, not EUR.

- The unit for certain currencies and products may only be available as a % unit.

- Differing commission schedules may impact markups. For example, if a broker has Pro Tiered configured while the client has Pro Fixed, the broker will receive a monthly aggregate volume discount reached by their client trades. The client will still pay fixed commissions. For more information on commission schedules, please click here.

Note: Changes to the Fee Per Trade Unit on a client account do not require client approval and take effect on the following business day.

Introducing Broker client markups are limited to 15 times IBKR's highest tiered rate + external fees. In the case of US stocks, the highest tiered rate would be 0.0035 USD per share. USD-denominated bonds are subject to a separate cap on mark-ups. US option mark-ups are limited to 10% of trade value. 25% of debit interest markups over 1% will be collected by IBKR. These limits are subject to change, and specific products may have an additional limit in place. No markups will be applied if a client calls IBKR to close a position.