Margin Requirements

Instructions

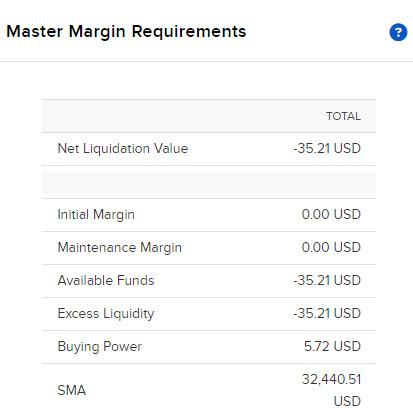

The Margin Requirements panel on the Home screen shows you the current margin requirements for your account, including:

- Initial Margin: The minimum amount of equity required to open a new position.

- Maintenance Margin: The amount of equity required to maintain your current positions.

- Available Funds: The amount of funds you have available for trading.

For securities, this is equal to Equity with Loan Value – Initial Margin.

For commodities, this is equal to Net Liquidation Value – Initial Margin. - Excess Liquidity: This is your margin cushion.

For securities, this is equal to Equity with Loan Value – Maintenance Margin.

For commodities, this Net Liquidation Value – Maintenance Margin. - Buying Power: The maximum amount of equity available to buy securities. In a Margin account, Buying Power gives you additional leverage to make trades, increasing your potential gain but also increasing your risk.

In a Cash account, Buying Power = Minimum (Equity with Loan Value, Previous Day Equity with Loan Value) – Initial Margin.

In a Margin Account, Buying Power = (Minimum (Equity with Loan Value, Previous Day Equity with Loan Value) – Initial Margin) *4 - SMA: SMA (Special Memorandum Account) is a line of credit created when the market value of securities in a Margin account increases in value and maintained for the purpose of applying Federal Regulation T initial margin requirements at the end of the trading day. If the SMA balance at the end of the trading day is negative, your account is subject to liquidation.

-

To view this information, click Menu in the top left corner > Home > Master Margin Requirements on the right hand side

Note: For STL accounts, initial margining is determined for each individual account, while maintenance margining is determined at a consolidated account level.