Simple IRA Application

Instructions

The Simple IRA account is designed so that small businesses (less than 100 employees) may offer their employees a tax advantaged retirement program. There are no filing requirements for the employer and no initiation or operating costs. Employers cannot have any other employee sponsored plan. This is currently only offered to Employee Plan Administrators.

Note: Prior to inviting an employee to start a simple IRA application, an Independent Financial Advisor must first initiate a link request to the EPA (admin) account.

Detailed step by step instructions on the process of inviting an employee to start a simple IRA application have been listed below.

-

The Employer will navigate to the IBKR Website and click the red Open Account button in the upper right-hand corner.

-

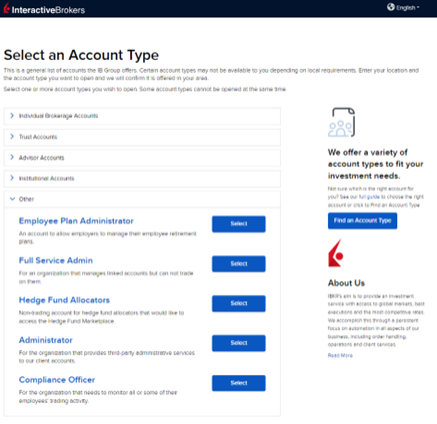

The Employer will be prompted to begin a new application. Be sure to select the Employee Plan Administrator account type.

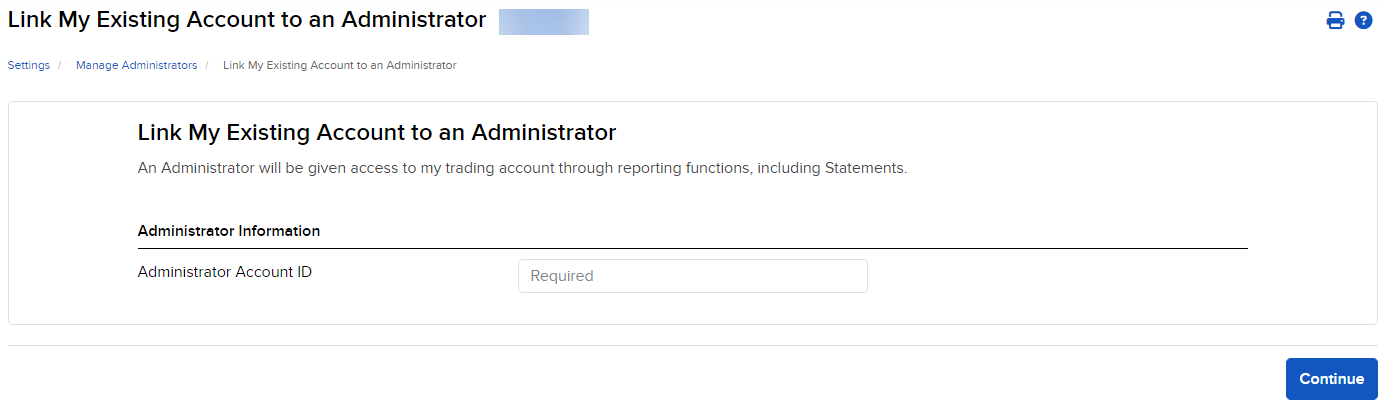

The independent financial advisor will initiate the link request to the EPA account. To request a link to an EPA account, the advisor will need the EPA’s IBKR account number.

-

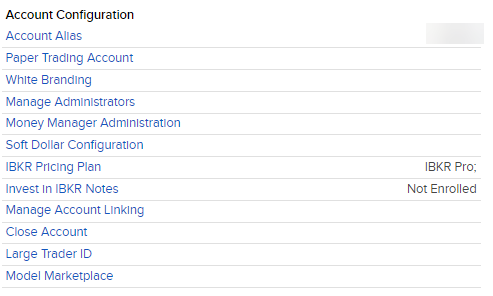

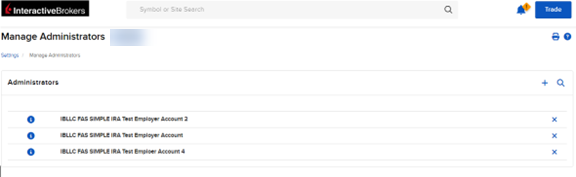

From the Advisor Portal, navigate to the Settings page and select Manage Administrators from the Account Configuration section.

-

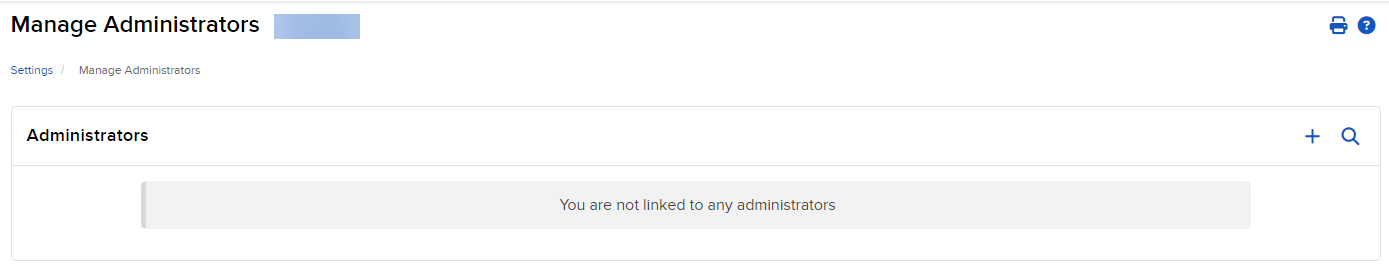

On the Manage Administrators screen, the advisor will click the “+” icon.

-

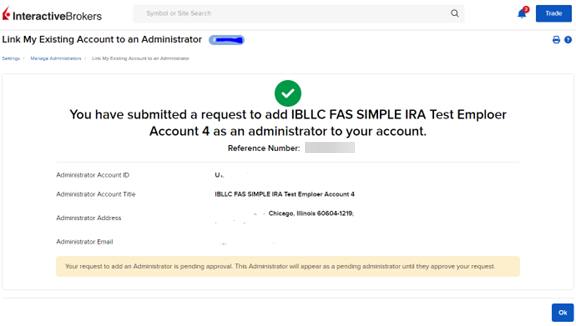

The advisor will receive a confirmation once the request has been successfully submitted.

-

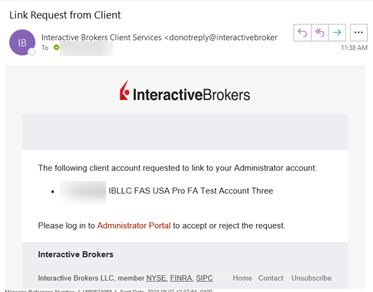

Notification of link request: The EPA will receive an email and Message Center notification alerting them to a link request which has been submitted.

-

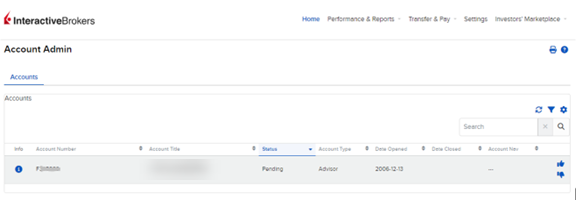

On the Portal home page, the EPA will see the pending request.

-

To Accept, the EPA will click the ‘thumbs up’ icon.

-

To Reject, the EPA will click the ‘thumbs down’ icon.

Note: The EPA can have only one active relationship with an advisor

-

Upon acceptance of the link, the advisor will be sent a notification.

The EPA will navigate to the Settings page to see the advisor association post link approval.

-

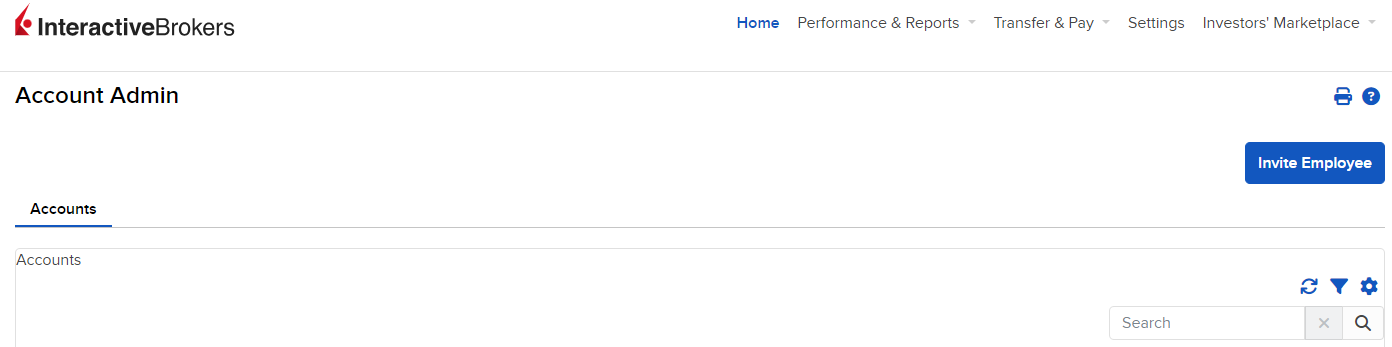

After the link has been established, the EPA will be presented with a blue ‘Invite Employee’ button on the Home Page in the Portal. Click this button.

-

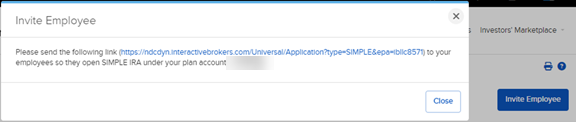

To invite an employee to open an account with the established advisor, the EPA must send the unique link shown in the ‘Invite Employee’ dialog box.

-

The employee will complete a fully electronic account application that will be associated with the advisor.

Note: Advisor fees can only be configured after the employee’s account has been approved and will only become effective once the client has consented.

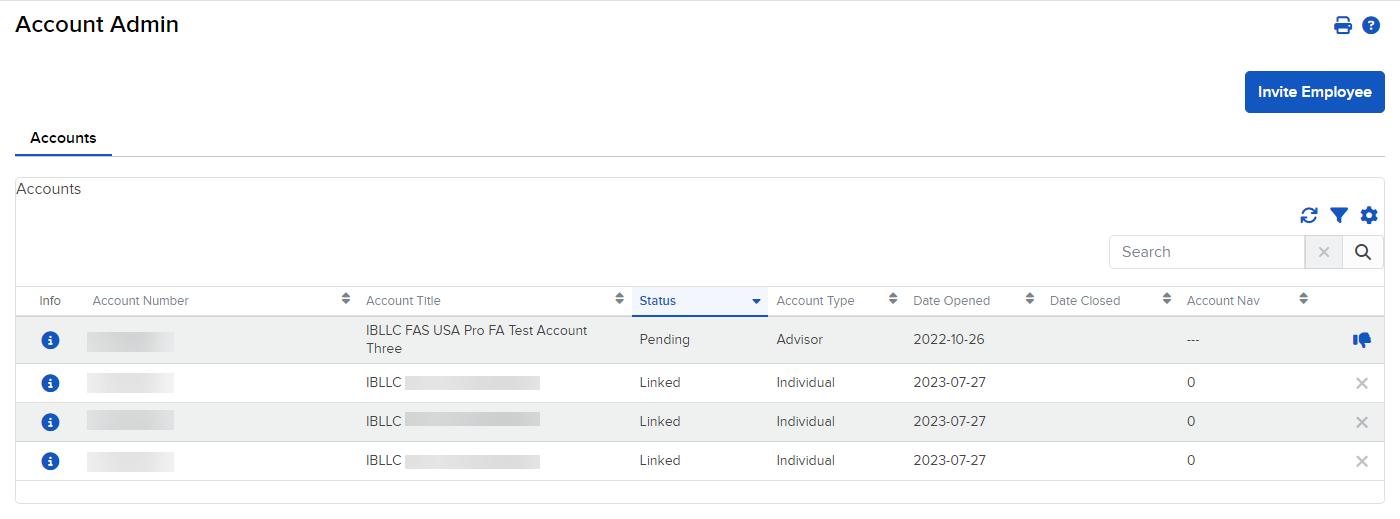

Once employee accounts have been approved, they will appear in the EPA Portal.

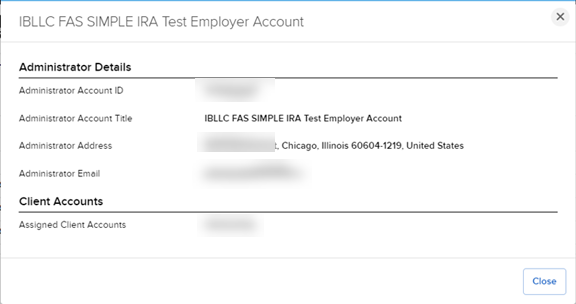

Advisors may see the list of associated Employers in the Manage Administrators screen.

Click the information icon to view the EPA information and the client accounts associated with that EPA.

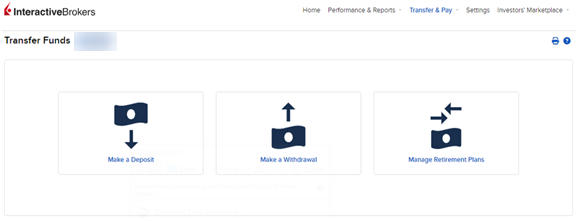

Employers will deposit funds to their EPA accounts and then provide IBKR with instruction on which accounts to distribute the funds to and how to code the distributions.

-

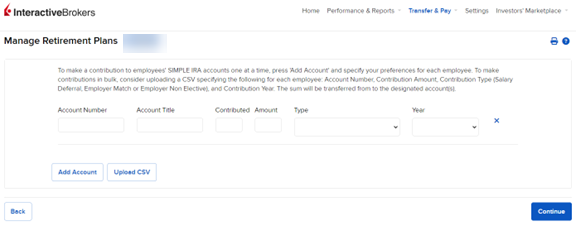

To manage the funding tasks, the EPA will navigate to the Transfer & Pay > select Transfer Funds > select Manage Retirement Plans.

-

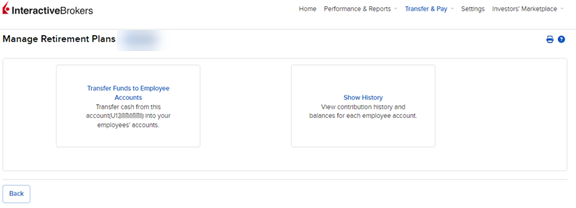

The Manager Retirement Plans screen provided EPAs with 2 functions - Transfer Funds to Employee Accounts and Show History. Select Transfer Funds to Employee Accounts

-

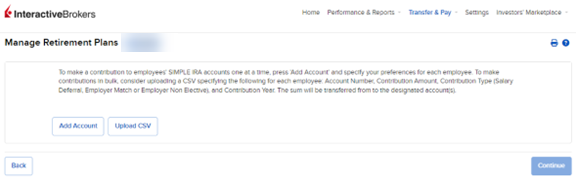

To fund accounts, we provide 2 means - Individual Entry and CSV Upload.

-

Individual Entry - Advisors select an employee account from the Account Number dropdown. The Account Title, Contribution and Year will prepopulate. Advisors will need to provide the Amount and the Type.

-

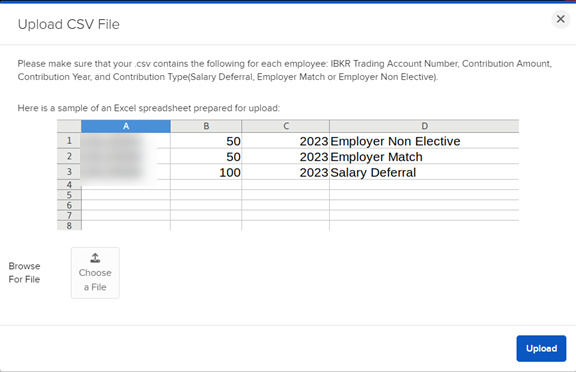

CSV Upload - EPAs can upload a file containing the funding instructions for quicker processing.

-